eCommerce accounting tool for online sellers

Simplify how you manage your online sales. Instantly organise your sales data in a tax-compliant, standardised view. Dext Commerce is an essential tool for eCommerce sellers.

Simplifying digital sales accounting for online sellers

Dext Commerce is the essential tool for ecommerce accounting services. Use Dext Commerce to group, organise and export your sales transactions into your accounting software of choice.

Accurate sales data extraction tool

Dext Commerce fetches transactions from the world’s largest retailers, marketplaces, e-commerce platforms, point of sale systems and payment providers. Allowing a streamlined, modern approach to managing ecommerce bookkeeping and online accounting.

Effortlessly export your sales data

Export your standardised sales data to either Xero or QuickBooks Online – whether that’s in bulk or one by one.

Effortlessly export your sales data

Export your standardised sales data to either Xero or QuickBooks Online – whether that’s in bulk or one by one.

Unlock real-time sales data

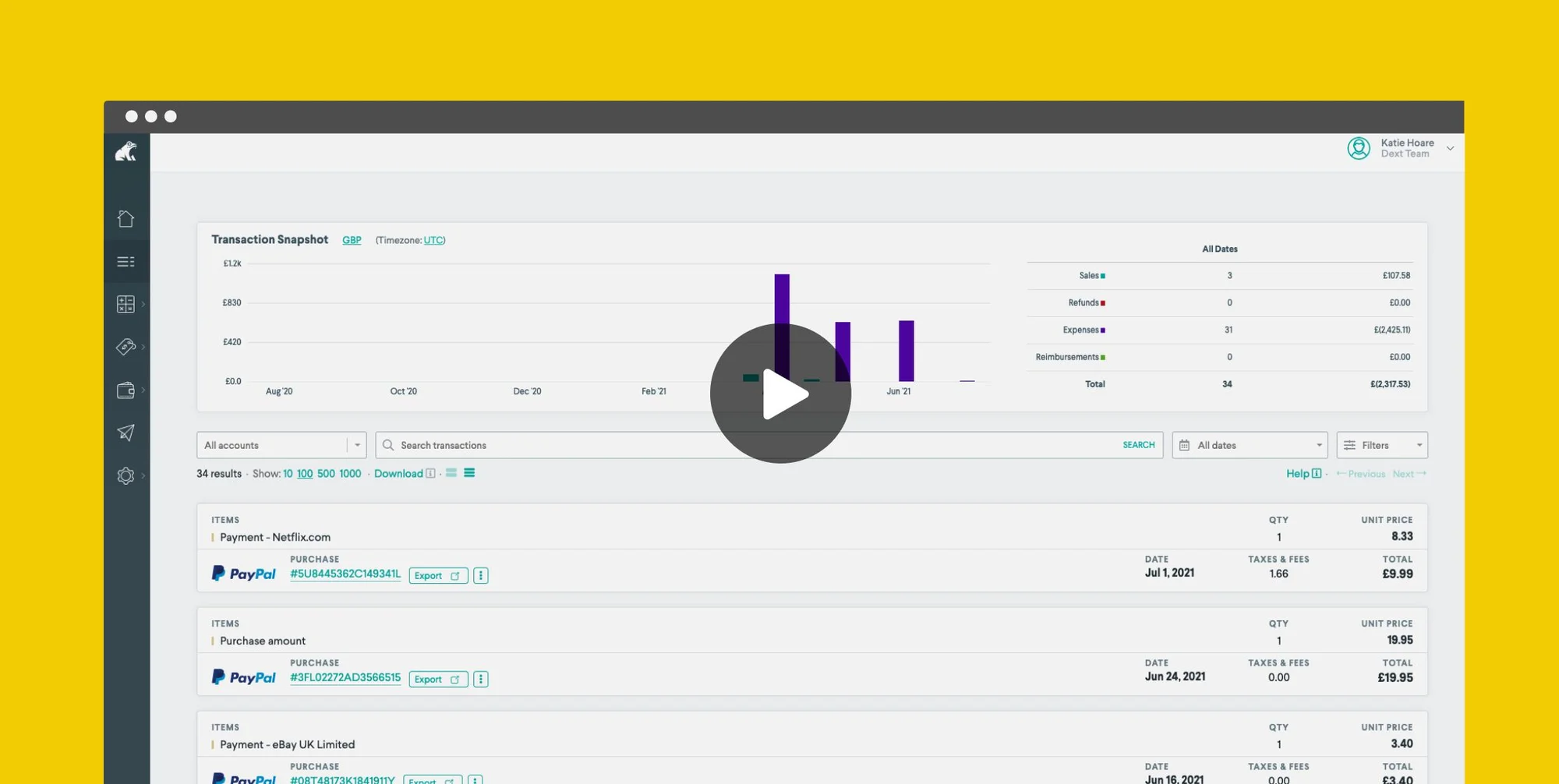

With Dext Commerce, you get the full financial picture. We ensure your sales data is tax compliant, standardised and, above all else, simple. Watch the video below.

Modernised plan for ecommerce business

Ensure your documents meet new source data regulations, like Making Tax Digital (MTD).

Learn more about Expense Management for Business Owners

Tax ready data

Split out payment processing fees and taxes. Account accurately for your sales wherever you sell.

Real-time breakdown view

Stay on top of cut off dates, deferred revenue and more with real-time sales data in one standardised view.

Simple transactions feed

Fetch sales transactions, then separate and itemise your fees, refunds and reimbursements.

Complete connection to other accounting software and platforms

Sync with the world’s leading digital platforms, then export that data to your chosen accounting software.

Unmatched e-commerce technology

Simplify your online sales. Get a comprehensive list of revenue integrations in one single plan.

Trusted by 500,000+ businesses globally

FAQs

When determining your monthly transaction volume, Dext Commerce only counts those transactions that are authoritative in nature; in other words, the original sales or expense occurrence. We understand how difficult it is to predict your sales and expenses, so ancillary transactions like seller-related fees, refunds and reimbursements do not count against your plan's transaction count.

Sales transactions that are marked as archived, trashed or duplicated (due to a data transform) do not count against your plan's transaction limit either.

Dext Commerce is currently supported on all QuickBooks Online small business editions including Simple Start, Essentials, Plus and Advanced. At the moment, we do not support QuickBooks Desktop.This integration, however, is currently in the works and will be supported soon in an upcoming roadmap update.

That varies depending on the integration. For eBay, your data is only stored for 90 days but if your eBay transactions were settled using PayPal, Dext Commerce can back-fill summary level transactions going back three years. If you need Amazon Seller Central transactions older than 90 days, you need to specifically request historical statements from Amazon before Dext Commerce can fetch those transactions. In most cases, Dext Commerce can acquire multiple years of historical data.

As you export transactions, Dext Commerce is always learning how best to map transaction data to the appropriate accounts in your accounting file. For sales taxes, we’ll look for previously exported sales transactions that match the postal code of the current transaction and default to the appropriate tax rate/jurisdiction. Sales tax rate mappings can be overwritten at any time by manually defining a different tax rate from the drop menu.

For QuickBooks Online users, Dext Commerce exports your sales transactions as Sales Receipts (not invoices). There is little difference between the two other than a sales receipt is a more appropriate way of booking sales revenue collected at the time of the sale.

For Xero Users, we export your sales transactions using one of the following methods, (a) invoice + payment, or (b) direct transaction to a bank account.

eBay recently released its own Managed Payments platform with support for more payment options for buyers such as credit, debit, gift cards, Apple Pay, and Google Pay. In addition, eBay will continue to support PayPal and PayPal Credit. Transactions on Dext Commerce that were processed through Managed Payments will be inclusive of sales, payment processing fees, refunds and reimbursements. In those cases where you configure a PayPal payment method external to the eBay Managed Payments service. You will need to connect your PayPal account to Dext Commerce in order to sync your payment processing fees.

Most supported integrations on Dext Commerce will include applicable VAT taxes as a part of your transaction data, with the exception of Etsy. Etsy does not provide tax data for EU sellers.

Dext Commerce can solve this problem for Etsy sellers using a feature called VAT Transform. VAT transforms, when applied to your Etsy data, transform your transactions by applying the appropriate VAT rate to the transaction, creating a VAT tax line item within the transaction. When exporting the transaction to an accounting program, you can now easily categorise the VAT taxes. For the UK and EU, Dext Commerce will apply a 20% VAT tax rate.

Yes, sales receipts and invoices created within your accounting software will leverage the numbering logic within the accounting package itself. In almost all cases, sales receipts are numbered sequentially.

The good news is that they’re not missing. Amazon works a bit differently than some other marketplaces as to how they handle their settlements. As an Amazon Seller, your sales accrue over time. While Amazon will sometimes display your sales in certain reports, in reality they only truly remit payment to the Seller after the order is fulfilled. Once the order is marked as fulfilled, only then does Dext Commerce display them as settled transactions.

This means that the date when the item was purchased and the date we actually show it as settled are often different dates. Dext Commerce always references the actual settlement date in our systems, irrespective of the date when the customer purchased the product on their end.