Quick Guide to Building a Digital Commerce Accounting Tech Stack

In its simplest form, digital commerce - or d-commerce - is the buying and selling of products and services via digital channels. That includes websites, marketplaces (e-commerce) and commerce infrastructure such as POS systems and digital payments platforms - so both online and in-store.

Businesses of all shapes and sizes, across all sectors, are now having to embrace d-commerce practices as a way to stay competitive. And with few barriers to entry into the biggest global marketplaces like Amazon, Walmart, Etsy and Shopify, differentiation from the competition is now by far the biggest obstacle to achieving growth in 2022.

To overcome this challenge, organizations need to invest heavily in technology to facilitate sales, take payment, fulfil orders, generate commercial insights and to stay ahead. More than ever, businesses need to understand their customers and their shifting purchasing behaviors to inform their go-to-market strategies. They also need a detailed, real-time understanding of their cost base and their cash flow to inform their commercial decision-making.

This is where accounting partners, and their choice of digital commerce accounting tech stack, can accelerate (or hinder!) business growth; both for the firm’s and their clients’. For accountants that have yet to implement their tech stack, the window of opportunity is closing as firms everywhere are now waking up to the necessity.

“Accounting practices everywhere are having to adapt their services - and their tech stacks - to better support and enable their clients to establish competitive-advantage in today’s d-commerce environments.”

Nana Guenther, CPA, CA (Practice Solutions Expert)

But what is a digital commerce accounting tech stack?

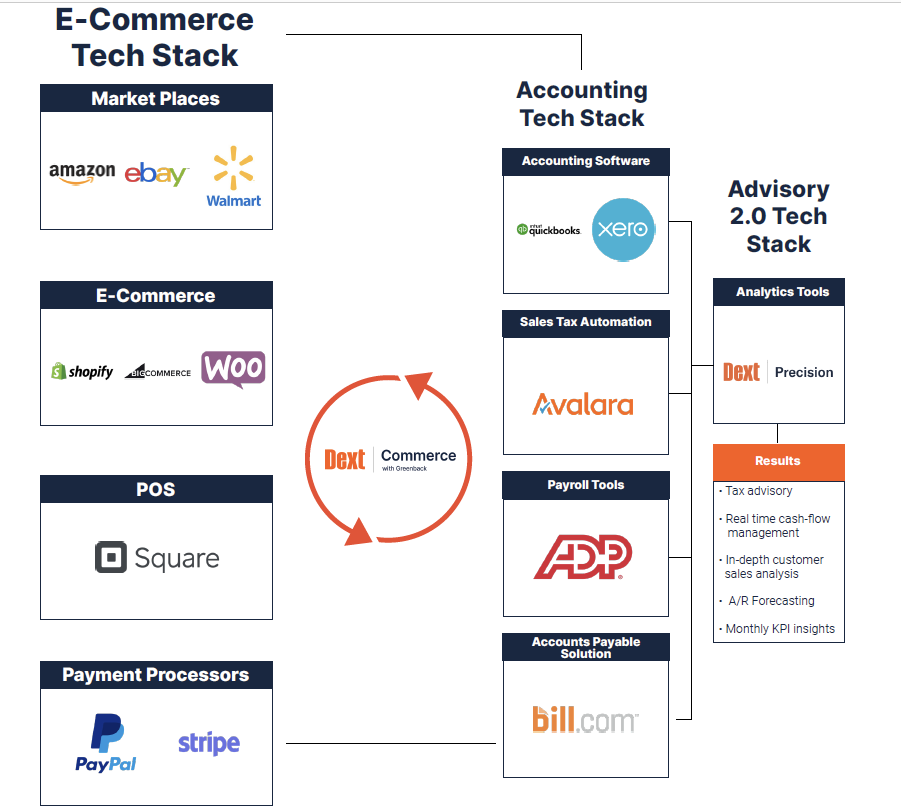

Put very simply, it’s the group of technologies an accounting firm implements to automate and integrate each stage of the accounting process - from retrieving data to providing clients with insights. A stack usually involves a database, tools to configure workflows, and an underlying programming code that automates those workflows. The most effective accounting stacks streamline workflows within a centralized database to facilitate flexible client management, calendaring, task tracking, reporting and so on.

Accounting firms can build their stack around their existing software, such as QuickBooks and Xero, to automate different tasks such as data retrieval, file sharing, document management and so on. At any point, a firm can modify its tech stack - or start over. Although the best practice advice when doing this is to:

- Be clear about the pain-points and bottlenecks you need to alleviate,

- Consider all costs (including set up, training and change management) and likely return on investment, and

- Build your stack for the long haul, ensuring it is cyber-secure by design.

The ultimate goal of your tech stack should be to help your clients make sense of the overwhelm of transactional data that their digital commerce businesses now generate on a daily basis. This is especially the case for small businesses who need their accounting partner to understand their specific challenges and help them build a plan of action. To do this, they need:

- Secure and easy data and document sharing

- Accurate general ledger data

- Real-time business insights

- Agile cashflow management

- Advisory services such as forecasting, and

- Technology recommendations

Thankfully, this does not mean that your firm needs to be proficient in all of the 600-plus d-commerce technology platforms that clients have implemented. But you do need to implement a tech stack that knows how to talk to these four types of platforms and extract accurate data. For example:

| Digital Marketplaces | E-commerce platforms | Point Of Sale systems | Payment providers |

| Online platforms for both sellers and buyers, matching buyers seeking a product with sellers or providers of those products. | Online platform that allows buyers to sell directly from their personal website. | Accepts payments for products online or in a physical store using digital payment methods such as credit card, tap card, debit card, loyalty points or gift cards. | A service technology used by merchants to accept debit or credit card purchases from customers for goods or services. |

| Amazon, Shopify, Walmart | Woo Commerce, Big Commerce, Squarespace | Square | Paypal, Stripe |

Your stack also needs to be able to translate the huge variety of pre-accounting data inputs into accurate and insightful accounting outputs.

Here is an example of a digital commerce accounting stack capable of doing just that:

To learn more about how to build a tech stack that helps you effectively support your digital commerce clients, watch our on demand webinar here.