The release round-up – October 2024

Explore our latest feature updates and product announcements.

Welcome to Dext’s release round-up. We’ll be detailing the latest features and giving you a sneak peek at what’s on the way for Accountants and Bookkeepers. You can also find out more about our recently-announced product enhancement, and our plans to combine our three products into one integrated Dext experience.

What’s new?

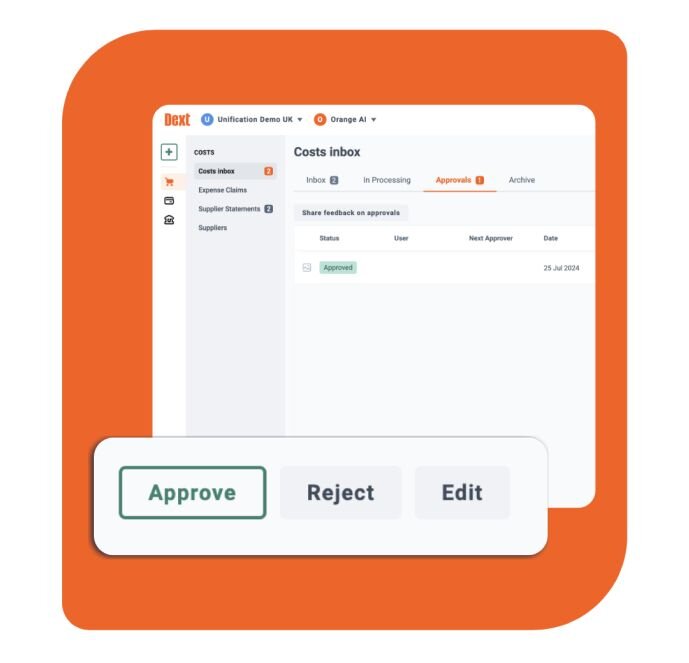

Approvals

Available in 🇬🇧 🇦🇺 🇨🇦 🇺🇲

(Coming soon 🇫🇷)

With Dext’s new Approvals feature for cost items, you can streamline your client’s approvals workflows, ensuring all transactions are verified and approved by the right people for greater accuracy and control.

- Compliance and reporting

- Reduce the time spent on manual checks, and minimise errors that could lead to incorrect tax figures

- Minimises risk of fraud and errors

- Assign different levels of approval permissions for both your clients' and your own practice's records. This minimises the risk of fraud and errors by ensuring that no single person has full control

- Additional value

- Provide your clients with this additional feature to help them streamline their internal processes and in turn increase client satisfaction

Image 1: Approvals feature

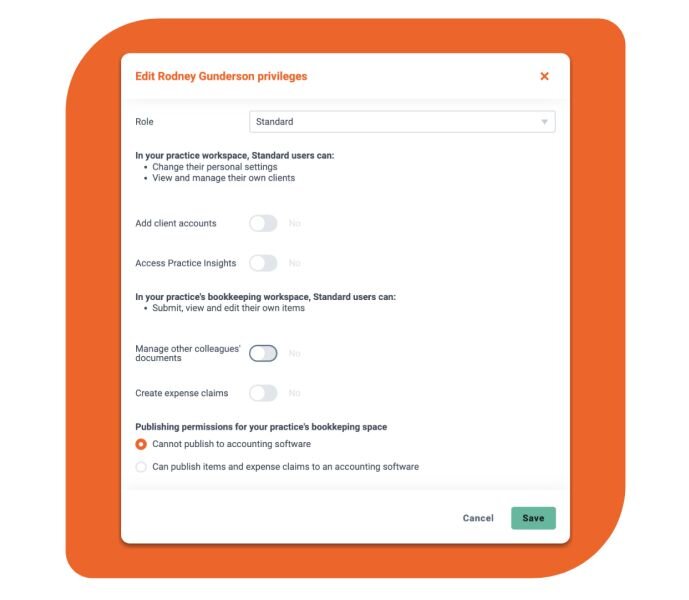

Updated roles and permissions

Available in 🇬🇧 🇦🇺 🇨🇦 🇺🇲 🇫🇷

We’ve updated roles and permissions, so you can better tailor access levels, this gives you greater control and flexibility and ensures users only see the information relevant to them. You can now assign one of three roles to your colleagues:

- Practice admins: The most advanced role. Users have full access to the Dext account at the practice level

- Client admins: Users can do everything at a practice level, including viewing all clients, but they can not manage anything at an account level

- Standard users: This is the most basic role. Users can only view their own clients and cannot manage anything at a practice level

Image 2: Roles and permissions

Coming soon

We’re always looking to build better so you can get even more from our product. Over the coming weeks and months, we’ll be releasing a host of new features and updates to further enhance your use of Dext.

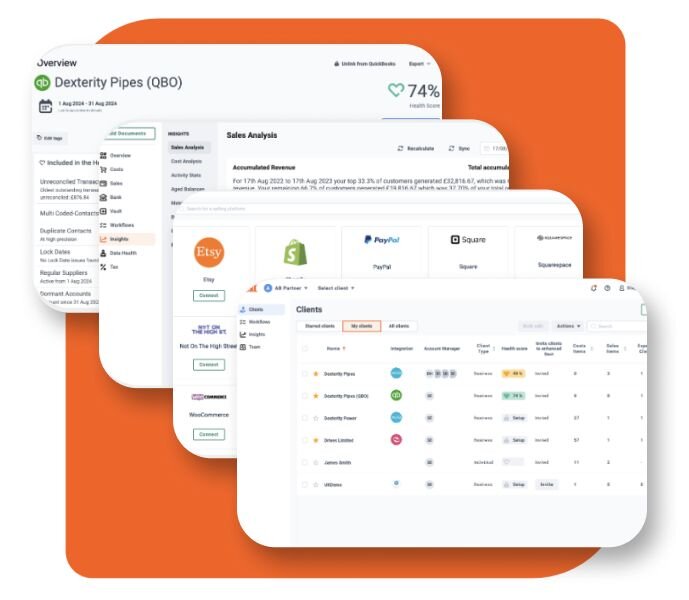

The evolution of Dext’s Bookkeeping Automation Platform

Available in 🇬🇧 🇦🇺 🇨🇦 🇺🇲

In September, we launched the first phase of the enhanced Dext experience. You’ll now have access to an improved and intuitive interface, simplified partner and client settings, easier navigation and a dedicated insights space.

Introducing Dext Precision and Dext Commerce features to the platform

Soon, Dext Precision will become part of the unified Dext experience for our Partners. Previously a standalone product, Precision's key features—like data health monitoring, data clean-up, business insights, and practice dashboards—will be available as an add-on to existing Dext subscriptions.

This integration allows you to manage and optimise your clients' and your practice's financial data within a single platform. For clients selling online, the integration of selected Dext Commerce features will enable you to connect platforms like Shopify, Squarespace, or Wix, automatically syncing sales and costs into their Dext inbox.

Stay tuned for more updates, as we continue to release new features and enhancements over the coming weeks and months to further improve your Dext experience.

Image 3: The Dext Bookkeeping Automation Platform

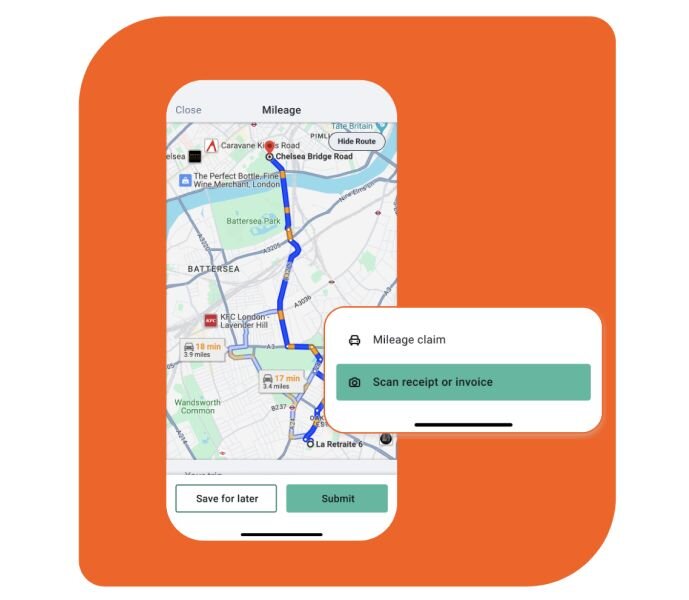

Mileage

Available in 🇬🇧 🇦🇺 🇨🇦 🇺🇲 🇫🇷

You’ll soon be able to simplify mileage tracking with our new Dext expense feature, designed to automate the process for employees and businesses. Users can automatically track trips, plan routes and accurately calculate claims based on approved rates – all the while reducing manual entry and errors. Available on the Dext web app and mobile app.

Automates mileage tracking

Simplifies mileage expense by automatically tracking trips using GPS, then calculating claims based on tax rates, reducing manual entry and any potential errors.

Ensures precision and compliance

Enables accurate route planning and tax-rate application, ensuring compliance with company policies and precise mileage reimbursements

Streamlines expense management

Integrates seamlessly with accounting systems, streamlining the expense process and ensuring timely, accurate reimbursements for employees and businesses.

Image 4: Mileage tracking feature

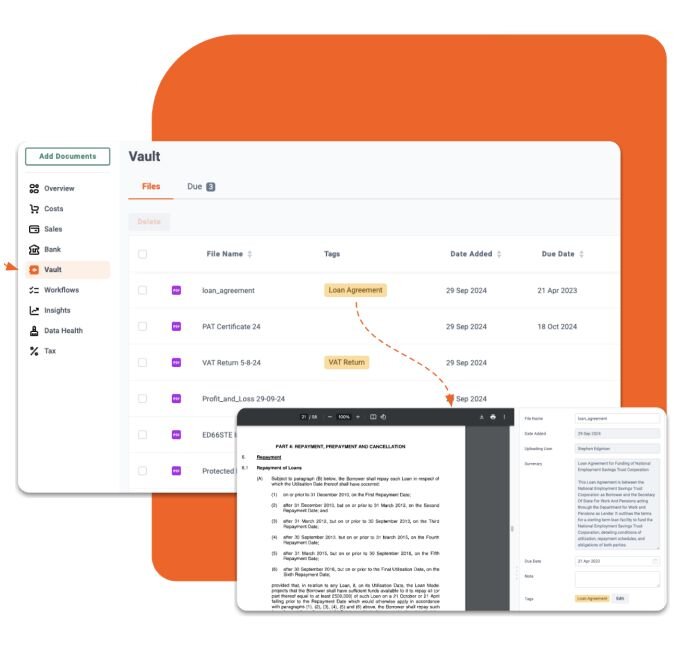

Vault

Available in 🇬🇧 🇦🇺 🇨🇦 🇺🇲 🇫🇷

We’re excited to announce Vault – a new space designed to help clients and practices stay organised by securely storing all key documents such as contracts, leases, loans, insurance policies, agreements, certificates, engagement letters, and management accounts.

Vault allows you to easily find, request, and share documents with clients. With intelligent features such as summarisation, reminders, and labelling, it automatically extracts important details like dates and links documents to the relevant customers, suppliers, or projects. Even better, a basic space is included for free, offering a secure and efficient solution for managing your documents. You can now register for early access via the link below.

Image 5: Dext Vault

Dext Payments: Coming in 2025

We are thrilled to announce Dext Payments, set to be introduced in 2025. This new feature will build on Dext’s existing approvals functionality, enabling you to automate the payment of invoices and expense claims directly within Dext.

Recent releases

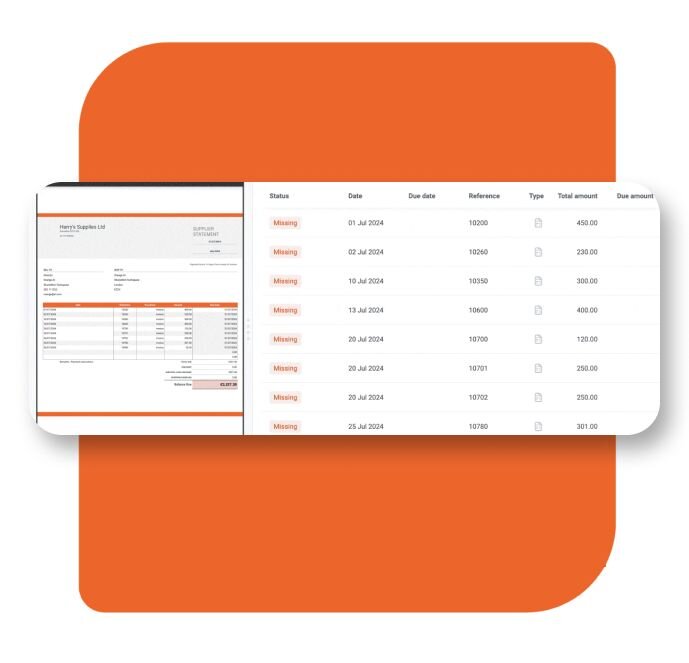

Supplier Statements

Available in 🇬🇧 🇨🇦 🇺🇲 🇦🇺

(Available in France very soon)

Since its launch, over 10,000 users have accessed Supplier Statements, submitting more than 100,000 statements to date. This powerful feature automates supplier statement reconciliation for accountants, bookkeepers, and businesses, helping you maintain accurate financial records and ensure timely payments to suppliers.

We extract all the essential information from a supplier statement, including the statement date, payable balance, and details of invoices and credit notes, before scanning for any missing information. After we assign a status to each line, you’ll have a clear view of which invoices are already in the system and what still needs to be added.

Image 6: Supplier Statements

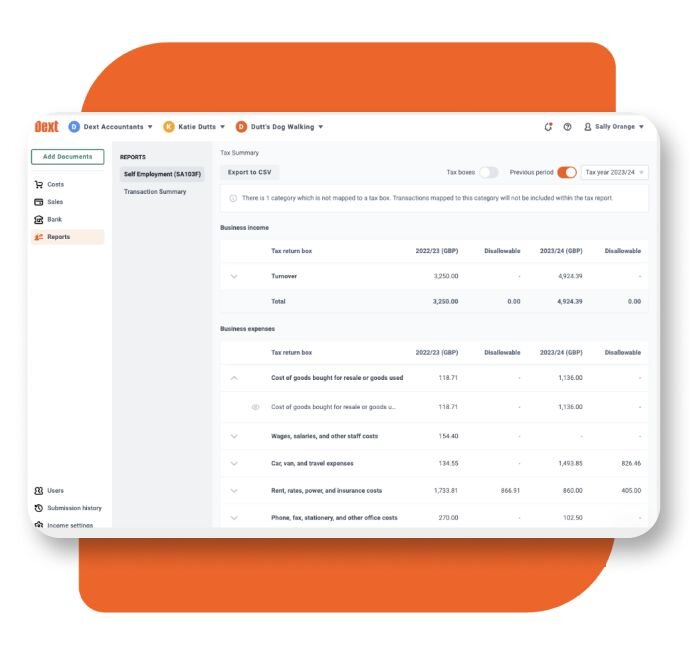

Solo updates

Available in 🇬🇧

Dext has a specially-built solution for MTD ITSA legislation in the UK. Solo takes the core functionality from Dext and allows you to use it for MTD ITSA and non MTD-ITSA clients. Our solution streamlines workflows for non-VAT-registered, self-employed and landlord clients, ensuring accuracy and providing you with real-time insights into clients’ data. It also enables your clients to capture and code transactions, analyse their numbers to make better decisions and feel confident about paying the right amount of tax.

Recent updates to Solo

- New migration tool to seamlessly move clients from Dext Prepare to Dext Solo

- Customisable chart of accounts mapped to tax return boxes

- SA103F and SA105 reporting

- Improved reporting for analytical review

- Advanced search to efficiently find documents

Image 7: Solo

Get involved

We’re hosting our product webinar again but tailored specifically to business customers, you can invite your clients too. Just share the registration links below with them.

Shape the future of Dext by joining our research panel to get a preview on what we’re working on and provide feedback. Simply fill out the 2-minute form to receive an invitation to join the panel.