AI in Accounting: How Intelligent Automation Transforms Firms

Key Takeaways

AI in accounting automates data-heavy, rules-based tasks, enabling accountants and bookkeepers to focus on professional judgement and client advisory work.

Intelligent automation improves accuracy and consistency by processing financial data at scale while reducing manual effort and rework.

AI agents support accounting workflows without replacing human control, applying only approved rules within defined guardrails.

AI-enabled practices are more scalable and resilient, relying on embedded workflows rather than manual processing or individual effort.

Responsible AI adoption strengthens trust, giving firms better data quality, clearer insights, and more time for client relationships.

Summary

AI is rapidly becoming embedded in everyday accounting and bookkeeping workflows, shifting expectations across the profession. Rather than replacing human intelligence, it is increasingly used to process large volumes of data, apply known rules consistently and automate repetitive tasks — creating capacity for accountants and bookkeepers to focus on professional judgement, client relationships and higher-value work.

AI in practice

Artificial intelligence is no longer something accounting practices are “experimenting” with on the side. It is becoming a core part of the financial workflow, quietly transforming how data is collected, processed and turned into insight.

What we’re seeing now is not hype. It’s a shift in expectations. AI is moving from novelty to necessity, and practices that understand how to apply it responsibly will be best placed to scale, retain talent and deliver higher-value services.

This is the new era of AI in accounting practice and Dext is built for it.

From raw data to intelligence: the new industrial revolution

Today’s AI systems operate like modern factories. They take raw materials — documents, transactions, questions and data points — and process them at scale, producing structured outputs that humans can act on.

Across industries, AI-generated content is now overtaking human-generated content. Tens of millions of AI-generated images are created every day, the majority of social media posts are now AI-assisted, and generative AI is already embedded in a growing proportion of smartphones.

For accounting practices, this shift is even more profound. Financial data has always been abundant. The challenge has been turning it into something usable, consistently and at speed. AI changes that equation.

AI Adoption in Accounting: Opportunity Meets Caution

Despite widespread coverage of AI, many accounting professionals are still at the beginning of their journey. A significant proportion describe themselves as beginners, while others are curious but cautious or unsure where to start.

That caution is healthy.

Accountants and bookkeepers understand that professional judgement, accuracy and trust are non-negotiable. While most professionals recognise that AI brings real benefits, there is also strong consensus that it must operate within clear guardrails.

This reflects an important truth: AI is not about replacing human intelligence. It is about amplifying it.

Human Intelligence vs Artificial Intelligence

Human intelligence excels at judgement, evaluation and improvement. These are the skills that define great accountants and trusted advisers.

AI is different. It processes large volumes of data, applies rules consistently and performs repetitive tasks without fatigue. When used well, it frees people to focus on what they do best.

The most effective practices don’t hand over judgement to AI. Instead, they guide it.

This is where AI agents come in.

What AI agents are and what they’re not

AI agents are particularly effective when given tasks that:

Are repetitive

Follow known rules

Require consistency rather than interpretation

Need to be performed again and again

They are not designed to make subjective decisions or provide financial advice. Instead, they apply guidance you define — reliably, at scale and without distraction.

This distinction matters. It’s also why AI adoption is linked to higher job satisfaction. When AI removes manual, low-value work, teams spend more time on meaningful client interactions and professional development.

What does an AI-enabled practice look like

An AI-enabled practice doesn’t look radically different on the surface. What changes is what happens behind the scenes.

AI supports the workflow from data collection through to client service:

Capturing receipt and invoices accurately

Extracting and categorising information

Matching documents to bank transactions for bank reconciliation

Applying known accounting rules

Highlighting anomalies or improvement opportunities

This creates capacity, improves predictability and reduces reliance on manual processing — without compromising control.

The result is a more resilient, scalable practice built on an enabled tech stack rather than heroic effort.

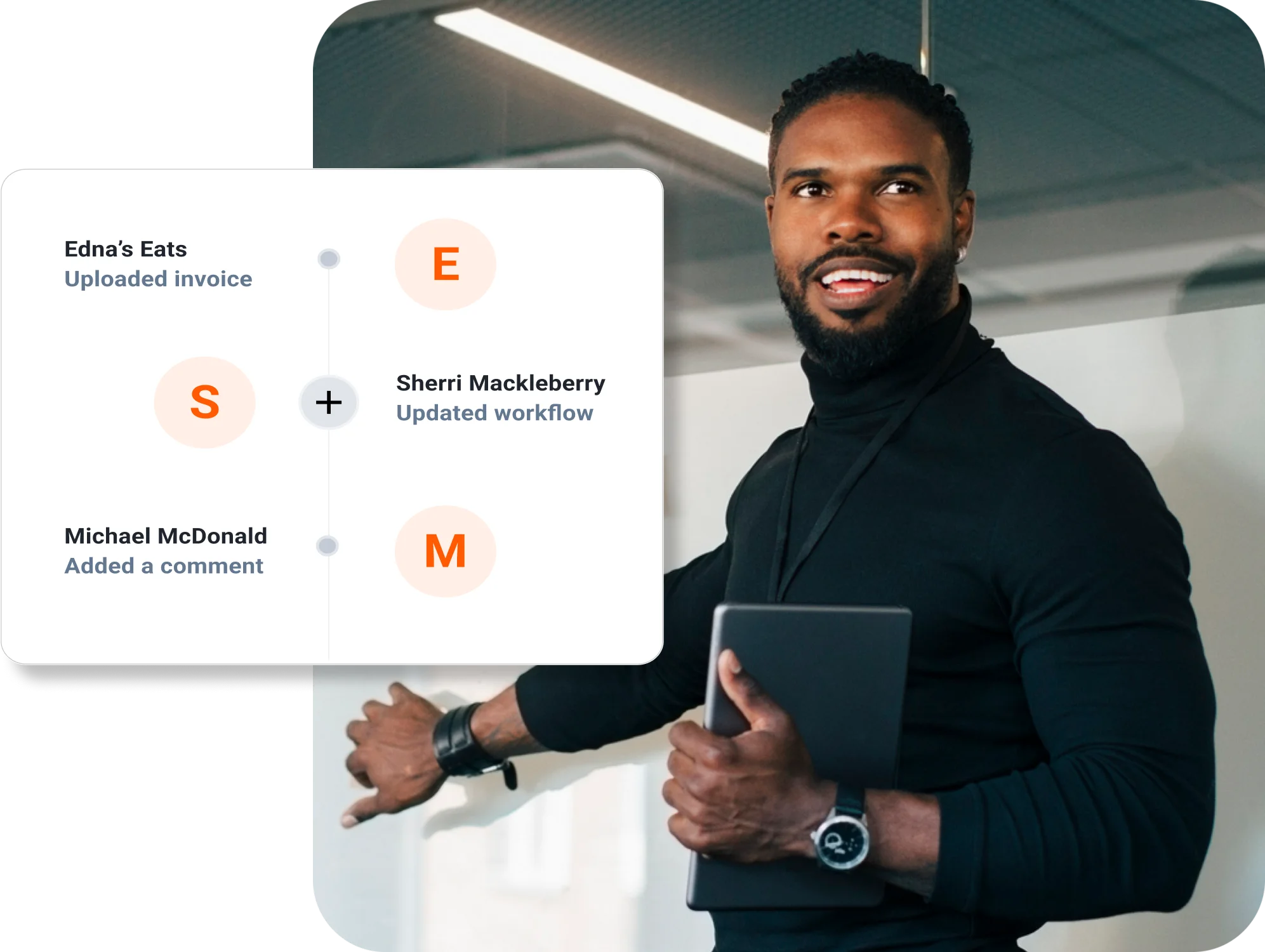

Why relationships still matter more than ever

As bookkeeping automation increases, relationships become more valuable, not less.

Clients don’t just want compliance. They want clarity, reassurance and insight. AI-supported workflows give accountants and bookkeepers the time and headspace to focus on those conversations.

By reducing manual bookkeeping, practices can:

Respond faster to client questions

Proactively identify issues

Deliver insights based on healthier, more complete data

Strengthen trust through consistency and accuracy

This is where technology like Dext makes a tangible difference.

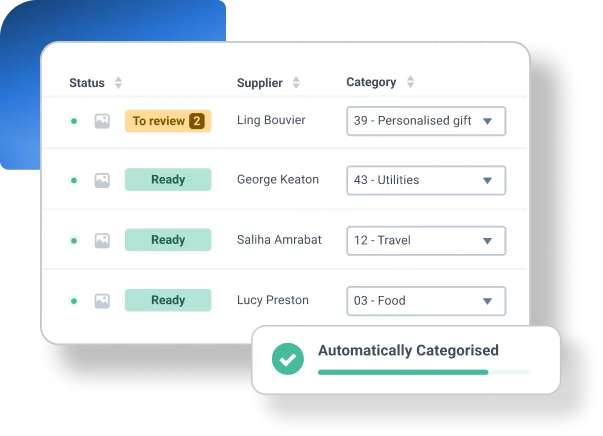

AI-Powered bookkeeping with Dext

Dext already processes tens of millions of documents every month using intelligent document processing. This includes:

Automated data extraction from receipts, bills and invoices

Smart matching of documents to bank transactions

Embedded workflows and data management

Applying known accounting rules

The goal is simple: reduce manual work and improve data quality, automatically.

This foundation allows practices to look beyond individual tasks and focus on the bigger picture: productivity, profitability and client outcomes.

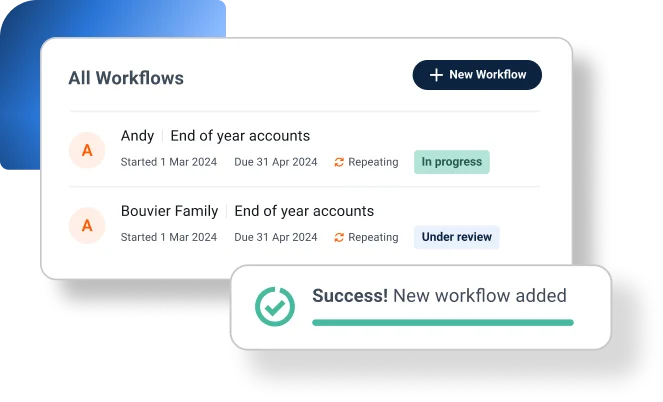

Introducing Dext Assist: AI with control and visibility

The next step in this journey is Dext Assist. Dext’s upcoming AI agent designed specifically for accounting and bookkeeping workflows.

Dext Assist is built around guidance, not guesswork.

When you start using it, Dext Assist will:

Generate suggested guidance

Automatically flag potential improvements

Allow you to turn actions on or off

Apply rules consistently once approved

For example:

Automatically selecting tracking categories based on supplier location

Flagging transactions as rebillable when specific keywords appear

Applying known rules for asset purchases such as vehicles

Supporting client-specific workflows using rules you define

Crucially, you remain in control. You have full visibility over what is applied and how it affects client data.

AI that works the way practices do

Unlike general-purpose AI tools, Dext’s AI is embedded directly into bookkeeping workflows. It doesn’t rely on memory across unrelated tasks, and it doesn’t replace professional judgement.

Instead, it supports your team by:

Applying rules consistently

Reducing rework

Highlighting where attention is needed

Freeing time for higher-value work

With additional insights such as time spent per client, practices can make better decisions about resourcing, pricing and service mix.

Responsible AI, built for trust

Trust remains central to AI adoption in accounting. Concerns around accuracy, misuse and regulation are valid. Particularly as evidence shows that ungoverned AI can produce misleading financial guidance.

That’s why Dext takes a responsible approach to AI design, supported by clear controls and transparency. You can learn more about Dext’s approach to security, governance and controls at Trust.Dext.com.

AI should enhance professional standards, not undermine them.

The new era of accounting has already started

AI is no longer a future concept. It is already embedded in the tools practices use every day and it’s raising expectations across the profession.

The firms that succeed won’t be those that adopt AI blindly, or avoid it entirely. They will be the ones that apply it thoughtfully, with clear guardrails, strong workflows and human judgement at the centre.

Dext is building AI bookkeeping software that works the way accountants and bookkeepers do. Turning data into insight, reducing manual effort and creating space for better client relationships.

Start preparing your practice for the next era of productivity. Start your free 14-day trial today.

Try Dext yourself with our 14-day free trial

Discover why over 700,000 customers worldwide use Dext to make more time for business and what they do best.