How to Track Changes in Xero with Dext Precision

We’re sure you know how challenging it can be to identify historical changes in Xero. Fortunately, Dext Precision makes that process a whole lot easier.

A common problem

As an accountant, you’ll know the demands of regular reporting on the financial accounts of a business. Whether you operate on a monthly, quarterly or annual basis, there will always be a need for up-to-date, accurate data that demonstrates the performance of a business to either its board of directors or the tax authorities.

When these numbers are incorrect, it can have significant consequences on the board’s ability to make effective decisions and then implement them. What’s even more frustrating is that accounts can be changed unknowingly after the period has been closed and reported upon. Sometimes, the control is out of your hands.

"I would be surprised if you came across an accountant that hadn't had this issue" - Craig Bailey, FD Works

Xero has a concept of Locked Periods and restricts changes within these periods to users with Advisor permissions, but these are not always kept up to date and even if they are it is still relatively easy for an advisor to make a change (mistakenly or miscommunicated).

Something has changed, but where?

Once an accountant identifies that their numbers for a previous period have changed, they generally have two options:

- Option 1: Find the transaction(s) that caused the change, and move them to the current period

- Option 2: Adjust the current numbers to account for the variance, in this month and in all preceding months until year-end. This option is only possible if the accounts have not already been filed with the authorities.

Most accountants using Xero have to spend several hours finding a variance by pouring through the accounts, starting at a high level and digging progressively deeper in areas that look incorrect until they have found the problem transaction or transactions. The larger your business is, the longer this process takes.

The variance may not be apparent immediately, and it may be some time before it's spotted and an investigation launched. Variances needing investigation at year-end take longer to find due to the cumulative build-up of transactions.

Xero have created a History and Notes Activity Report and an Assurance Dashboard Report to try and address this issue. But there is an even more straightforward solution.

What’s the alternative?

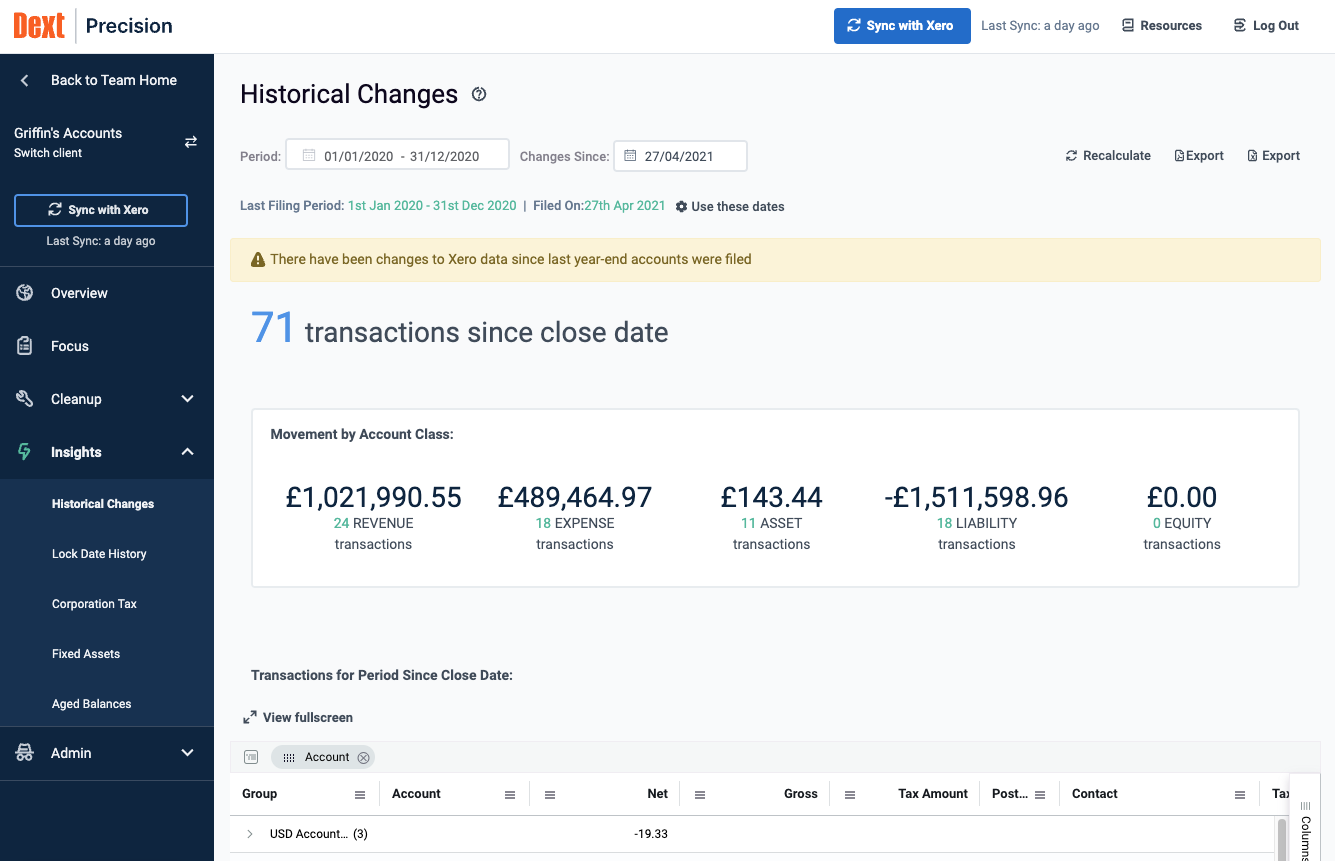

Dext Precision is a process-improving data insights tool that deeply integrates with Xero and QuickBooks Online. Through automated quality checks, Precision shows you your client’s data analysis and inaccuracies and helps you correct them within seconds. We’ve also built insight-based functionality that allows you to see whether there have been changes within a historical period after the reporting close date, and if so, what and when.

Simply set the period start and end dates and the reporting close date (the date you stopped making changes and produced your reports) and click Run Report. Within a few seconds Precision will produce your results. You can jump straight to the offending transaction(s) in Xero from the results. And, in case you need to show someone else where it all went wrong, you can always export the results to PDF.

If you’d like to learn more about this feature, click below and find out how Dext Precision can help you.