Making Tax Digital: Comprehensive guide for 2026

Making Tax Digital for Income Tax (MTD IT) is the biggest change to the UK tax system in decades. From April 2026, sole traders and landlords earning over £50,000 must keep digital records and submit quarterly updates to HMRC using compliant software.

As an accountant or bookkeeper, this affects how you price services, engage clients and manage workflows. But MTD IT is about opportunities, not just obligations. This guide walks you through everything you need to navigate it with confidence.

What is Making Tax Digital (MTD)?

MTD is HMRC's long-term plan to digitise the UK tax system, replacing manual work, paper-based tax returns with a modern, software-driven approach to compliance. The goal is simple: reduce errors, improve accuracy, and make tax easier to get right.

Making Tax Digital began with MTD for VATin 2019. MTD for Income Tax (MTD IT) is next. and Corporation Tax will follow.

What is MTD for Income Tax (MTD IT)?

Making Tax Digital for Income Tax changes the way sole-traders and landlords submit Income Tax returns. Instead of filling just once a year, taxpayers must maintain digital records and submit updates more frequently via HMRC recognised mtd software. Those earning above £50,000 join the system first, in April 2026, followed by those earning over £30,000 in April 2027, and £20,000 in April 2028.

What does MTD mean for accountants?

Accountants must help clients switch to compliant software and support quarterly submissions.

Does MTD change tax laws?

No – it changes how data is reported, not the tax rules themselves.

How does MTD for Income Tax work?

(New requirements)

Once under MTD IT, clients must:

Keep digital records using MTD compatible software.

Submit quarterly summaries of income and expenses to HMRC

File a final declaration after the tax year ends to confirm totals, as normal

Traditional spreadsheets are only accepted if connected to approved software for digital submission – and only under specific conditions.

In practice, this means your clients will go from one annual tax return to five required submissions each year. That shift reshapes how accountants manage time, workload, and communication with clients.

Are partnerships required to use MTD in 2026?

No, partnerships are not yet included.

Can clients be exempt from Making Tax Digital?

Yes – for low income, disability, or digital exclusion (with HMRC approval).

What penalties apply for non-compliance?

HMRC uses a points-based system. Repeated missed deadlines can lead to fines.

Can MTD improve client relationships?

Yes – real-time data supports proactive conversations and better outcomes

Expert advice: If your clients are already approaching these thresholds, they need to start preparing now.

Eligibility is based on income reported on Self Assessment tax returns two years before MTD starts – a rule HMRC calls ‘CY-2’ (Current Year minus two).

So for the April 2026 rollout, HMRC will look at income from the 2024/25 tax year to decide who must comply.

Who needs to comply and when? (MTD IT scope & timeline)

MTD ITSA is being phased in gradually. Here’s what the rollout looks like:

| Income threshold | Mandatory from | Who Is Included | Notes |

|---|---|---|---|

| £50,000+ | April 2026 | Sole traders & landlords | 1st wave of mandation |

| £30,000+ | April 2027 | Sole traders & landlords | 2nd wave |

| £20,000+ | Around 2028 | Sole traders & landlords | TBC (likely 2028) |

| Partnerships | TBD | Not yet included | Future phase |

Income threshold timeline

Today

While MTD for IT is not yet mandatory, HMRC is encouraging firms to make a start now. Voluntary participation is open, which is a great way to trial new processes and systems before the legislation is made official.

April 2026 - Initial Rollout

The initial phase of MTD for IT – for sole traders and landlords with taxable income above £50,000 per annum (p.a.) – will come into play in April 2026. From this point onwards, those clients will have to keep digital records and submit them every quarter.

April 2027 - Phase Two

A year later, the threshold of £50,000 p.a. will be lowered to £30,000, potentially extending the legislation to more of your clients. Please bear this in mind when introducing any new processes and systems.

April 2028 - Phase Three

From 6 April 2028, the threshold will be reduced to £20,000. Whether a client exceeds will be tested based on 2026/2027 return.

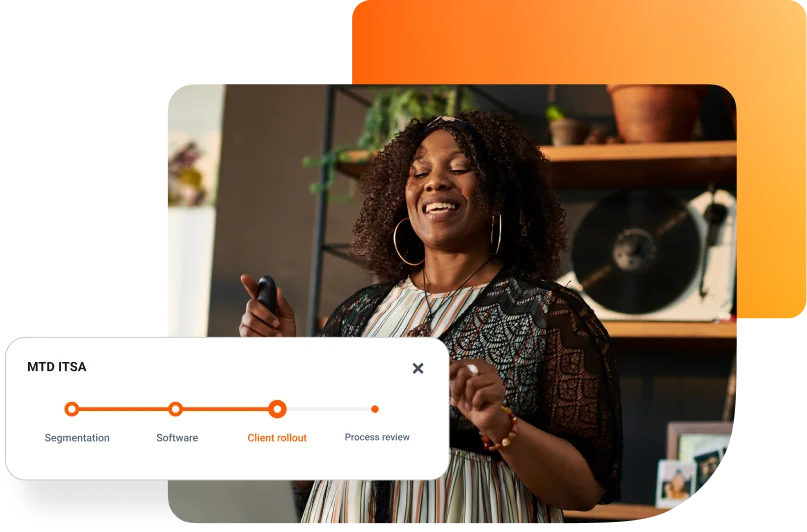

How to prepare your practice and clients for MTD IT

The most successful firms won’t wait until 2026. They’re starting now. Here's how to prepare:

Segment your client base: who’s above or near the threshold?

Review and adjust pricing: more frequent work means more touchpoints and new service tiers.

Choose your tech stack: pick tools that support efficiency, scale, and client experience.

Update engagement letters: reflect the shift to quarterly work and scope of service.

Train your team: everyone needs to understand the MTD workflow, tools, and client conversations.

Pilot with a test group: start small, learn fast, and scale gradually.

Start by identifying clients most likely to be impacted in 2026. Onboard them to software now, and use that time to refine your internal processes.

The new MTD IT penalty regime

There is a new penalty system for late filing under MTD for IT. Instead of incurring a penalty for missing a deadline, HMRC is moving towards a point-based penalty system. This means that for each missed filing obligation – quarterly updates and the finalisation – your client will incur a point. And when they reach a particular threshold, you will incur a £200 financial penalty.

2 points for an annual obligation such as the tax finalisation.

4 points for a quarterly obligation.

5 points for monthly obligations.

There are three points threholds

Important to know

Taxpayers joining the beta programme will be subject to the new penalty regime (for both late filing and late payment), except they will only face potential penalties for missing annual obligations; they will not accrue points in respect of late quarterly MTD for IT submissions.

If someone subject to MTD for IT has more than one business, there will be multiple quarterly MTD for IT returns/ obligations, but only one points total. So, if someone has two businesses and files the quarterly return for each of them late, only one point is incurred for that quarter, not two.

Points expire once the taxpayer has achieved a period of compliance (24 months for annual obligations, 12 months for quarterly obligations and 6 months for monthly obligations). There is also a new system covering penalties for late payment.

Feeling lost about MTD IT? We're here to help

Get ready for 2026 with a FREE Making Tax Digital for Income Tax consultation with one of our MTD experts here at Dext. See how Dext Solo can help your firm take control of MTD IT, one client at a time.

Download our MTD IT Guide

What you'll learn

The MTD IT fundamentals.

What firms should be thinking about MTD IT now.

Your MTD for Income Tax checklist

Product spotlight Dext Solo - compliant MTD software.

Benefits of digitalisation

The firms that digitise early will also find it easier to segment, automate, and upsell services to different client types.

For firms

Smoother workflows year round.

Better visibility of upcoming work.

Ability to shift to advisory conversations from compliance-only.

For clients

Fewer last-minute surprises.

More timely insights into finances.

Ongoing support and improved collaboration.

How does MTD IT improve client services?

MTD isn’t just about avoiding penalties. It’s an opportunity to improve service delivery and internal efficiency.

When should I start preparing clients?

Now. Income from 2024/25 determines 2026 mandation.

How do I register clients?

Through your Agent Services Account on HMRC’s portal.

Why MTD for Income Tax matters for accountants

MTD IT changes things – moving from reactive, end-of-year cleanups to proactive, year-round engagement.

Instead of chasing receipts in January, you’ll have steady data throughout the year.

That means

Forecasting tax bills earlier

Reducing January bottlenecks

Building stronger client relationship

Firms that embrace the change early will unlock new advisory opportunities and avoid being buried under deadlines later.

Challenges of MTD IT and how to overcome them

The transition won’t be without its pain points.

You may encounter:

Clients hesitant to adopt software.

Tight deadlines and new workflows.

Uncertainty around pricing and service scope.

To navigate this:

Start with clear client segmentation and a rollout plan.

Use onboarding materials and webinars to educate clients.

Offer tiered services: DIY, supported, or full-service.

Most importantly, don't wait. Testing your internal process early lets you spot gaps before deadlines hit.

Choosing the right MTD software for your firm

The software you choose will shape how smooth or stressful MTD IT becomes. If it’s clunky, confusing, or not built to scale, it will feel like you're in a continuous tax season. There are plenty of tools on the market, but not many that are purpose-built for MTD IT.

Here are a few things to prioritise when selecting your tool:

HMRC-recognised and fully compliant.

Specialist tools that work with your existing tax software; 'end to end' tools can cause problems.

A user-friendly tool that your client love to use as much as you.

mobile bookkeeping app alongside the main platform.

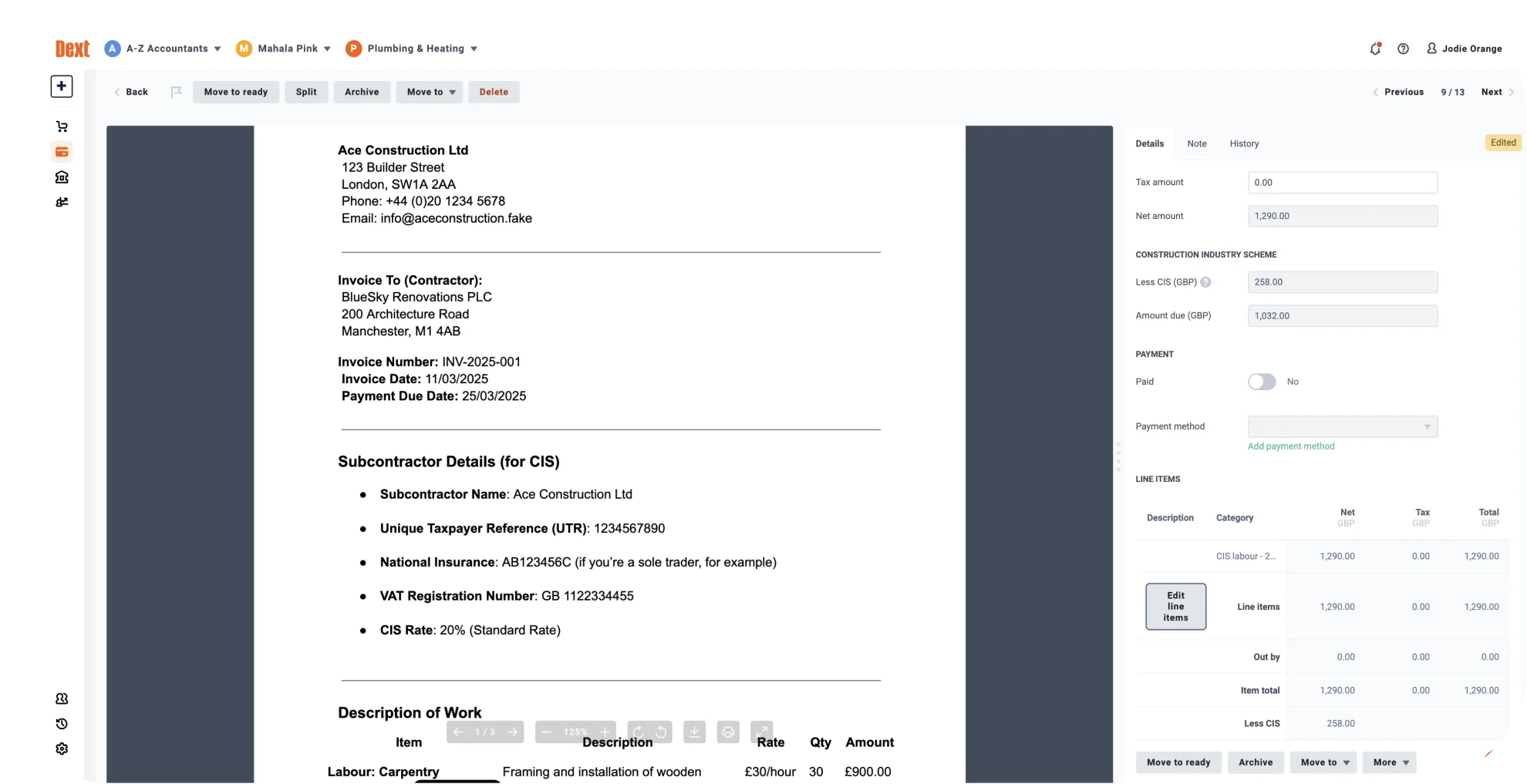

Dext Solo – a purpose-built tool for MTD IT

Designed specifically for sole traders and landlords, Dext Solo is ideal for clients who don’t need full accounting software but still need to stay compliant with MTD. It helps them capture receipts, categorise expenses (including disallowables), and process bank statements, giving you clean, accurate data that’s ready to submit.

It’s simple for clients, powerful for accountants, and scales easily across your portfolio.

HMRC-recognised and fully compliant

Easy for clients to use, efficient for your team

Designed for sole traders and landlords

Built with a multi-client dashboard for accountants.

Integrated with bank feeds and payroll.

Secure, well-supported and sensibly priced.

Start by identifying clients most likely to be impacted in 2026. Onboard them to software now, and use that time to refine your internal processes.

Handy resources

Accountants and landlords looking for extra information found the following resources helpful.

Answers to dozens of practical client and compliance questions

Learn more

MTD IT Cheat Sheet

Our tips on 6 core MTD IT points.

MTD IT Pricing Guide.

Understand how to price MTD at the right value for your firm in 2026.

MTD IT Webinars with Dext MTD experts.

Rewatch when you want our webinars about MTD and get ready for 2026.

99%

Market-leading accuracy means you can trust your data.

Conclusion

You now know who MTD IT affects, what it changes, and how to prepare. All that's left is for you to make a start.

Start with a small segment of clients. Trial your process. Choose a tool that scales with you. And prepare for 2026 now, not when the first quarterly deadline hits.

Want to get ahead of the curve?

Download our free guide: The Road to MTD 2026 – packed with templates, timelines, and rollout tips.

Many solutions now support both. Using one platform for both workflows can simplify processes and improve efficiency.

Dext offers onboarding, training sessions, help centres, and MTD-specific guides to support your team and your clients.

Yes – Dext Solo exports clean, categorised data in formats compatible with many tax and filing tools, including CSV.

For mandated businesses, MTD for Income Tax is compulsory. Following the rules will help you avoid the penalties and fines that come with non-compliance. Using Making Tax Digital software can also improve efficiency and accuracy. Dext offers automation features that can take care of repetitive admin for you. You also get a regular view of your tax liability, which makes planning for your bill easier.

You’ll need to use bridging software that connects spreadsheets to HMRC, in order to submit MTD compliant returns. Though, with the increased reporting requirements, using spreadsheets for MTD for IT could prove tricky. Dext provides software that lets you upload VAT amounts, then send MTD VAT standard rate returns from Dext.