How to Price for MTD IT in 2026

Everything you need to build a pricing model that reflects your firm’s value – from tiering services to communicating price changes with confidence.

Download our Pricing Guide for MTD IT

How to Price for MTD IT

MTD is changing how firms work and how they should price.

Quarterly submissions. Added advisory expectations. New client support needs. Compliance is no longer once-a-year — and that means your pricing can’t be either. This guide helps you build a future-proof pricing strategy for MTD IT that works for your firm, your clients, and your bottom line.

Why Pricing for MTD Matters

More submissions. More support. More value.

Switching from one annual tax return to five touchpoints a year is more than just admin. It changes how your firm operates.

You’ll be:

- In contact with clients more often

- Answering more setup and software questions

- Helping them understand new processes

- Providing ongoing support and troubleshooting

That added effort is real — and your pricing needs to reflect it.

But there’s also upside. With more frequent data, you can shift from reactive compliance to proactive advisory. Think: real-time cash flow insights, forecasting, and more valuable conversations.

MTD IT creates more work, but also more opportunity. Price accordingly.

Pro Tip: Be transparent about what's changing — clients will understand when you show how their support level is evolving too.

Three pricing models that work

There’s no one-size-fits-all. But these models can help you structure your MTD offer.

1. Tiered service model

Best for client flexibility. This approach allows clients to choose the level of service that fits their needs. It also gives you the framework to set clear expectations around who does what — especially if those roles and responsibilities are ever called into question.

| Service Level | What’s Included? | Price (Monthly) |

|---|---|---|

| Bronze/Basic (DIY support) |

Software access, email/phone support, quarterly submission checks. Client does the uploading and categorisation of all transactions |

£xx |

| Silver/Standard (Hybrid Approach) |

MTD software + setup, client uploads transactions, accountant/bookkeeper then categorises all transactions |

£xx |

| Gold/ Advanced (Full Service) |

All bookkeeping completed by the accountant/bookkeeper - paperbag job plus everything from the other packages. |

£xx |

You can even add a fourth package: the client handles all the bookkeeping and submissions, and you're only involved at final declaration stage.

2. Volume-based pricing

Best for firms working with high-transaction clients. Charge based on volume to ensure fair compensation.

This model works well on its own, but tends to deliver even better results when combined with tiered service packages.

| Transaction Volume (Monthly) |

Price (Monthly) |

|---|---|

| 0 - 50 transactions |

£xx |

| 51 - 200 transactions |

£xx |

| 201 - 500 transactions |

£xx |

| 501+ transactions | Custom pricing |

3. Hybrid model

For clients who only need MTD support, this model offers a simple standalone package. This model is ideal for those already doing their own bookkeeping.

1-50 transactions

| Tier |

Base monthly fee |

Transactions | Multiplier | Total monthly fee |

|---|---|---|---|---|

| Bronze | £50.00 | 1-50 | 1 | £50.00 |

| Silver | £75.00 | 1-50 | 1 | £75.00 |

| Gold | £100.00 | 1-50 | 1 | £100.00 |

51-200 transactions

| Tier |

Base monthly fee |

Transactions | Multiplier | Total monthly fee |

|---|---|---|---|---|

| Bronze | £50.00 | 51-200 | 1.25 | £62.50 |

| Silver | £75.00 | 51-200 | 1.25 | £93.75 |

| Gold | £100.00 | 51-200 | 1.25 | £125.00 |

201-500 transactions

| Tier |

Base monthly fee |

Transactions | Multiplier | Total monthly fee |

|---|---|---|---|---|

| Bronze | £50.00 | 201-500 | 1.5 | £75.00 |

| Silver | £75.00 | 201-500 | 1.5 | £112.50 |

| Gold | £100.00 | 201-500 | 1.5 | £150.00 |

Things to consider with the Hybrid model

- More transactions = more time: Factor this into your pricing to protect your margins.

- Avoid giving gold service for bronze prices: Poor recordkeeping increases your workload and reduces efficiency.

- Use an income stream multiplier: More income streams = more complexity = higher cost.

- Use proposal software for efficiency: Makes it easier to move clients from annual to quarterly billing.

Pro Tip: No matter the model, make sure your service scope is clear and documented. Ambiguity causes client confusion and team stress.

Add-on services (upsell opportunities)

| Additional Service | Pricing |

|---|---|

| MTD for IT software setup & training (this benefits everyone – particularly those on the cheapest package as you could establish set rules, ensuring more accurate records at the end) |

£xx (one-time) |

| Quarterly tax planning consultation | £xx per session |

| Annual accounts (if required) &

Self-assessment filing (finalisation) |

As before. |

Use this shift to position yourself as a proactive advisor:

- Quarterly reviews & check-ins

- Proactive cash flow planning

- Receipt digitisation and bank feed setup

- Reconciliation and bookkeeping upsells

Pro Tip: Tools like Dext Solo make it easy to collect, categorise, and clean data — reducing errors and making advisory easier.

Key Considerations When Pricing for MTD

Every client is different. Your pricing should reflect complexity, volume, and risk — and land in the Goldilocks zone.

Pricing for MTD is all about balance: enough to cover your time and tools, but not so high that it scares clients off. The sweet spot depends on how well you scope your services, tier your offer, and communicate value to your clients.

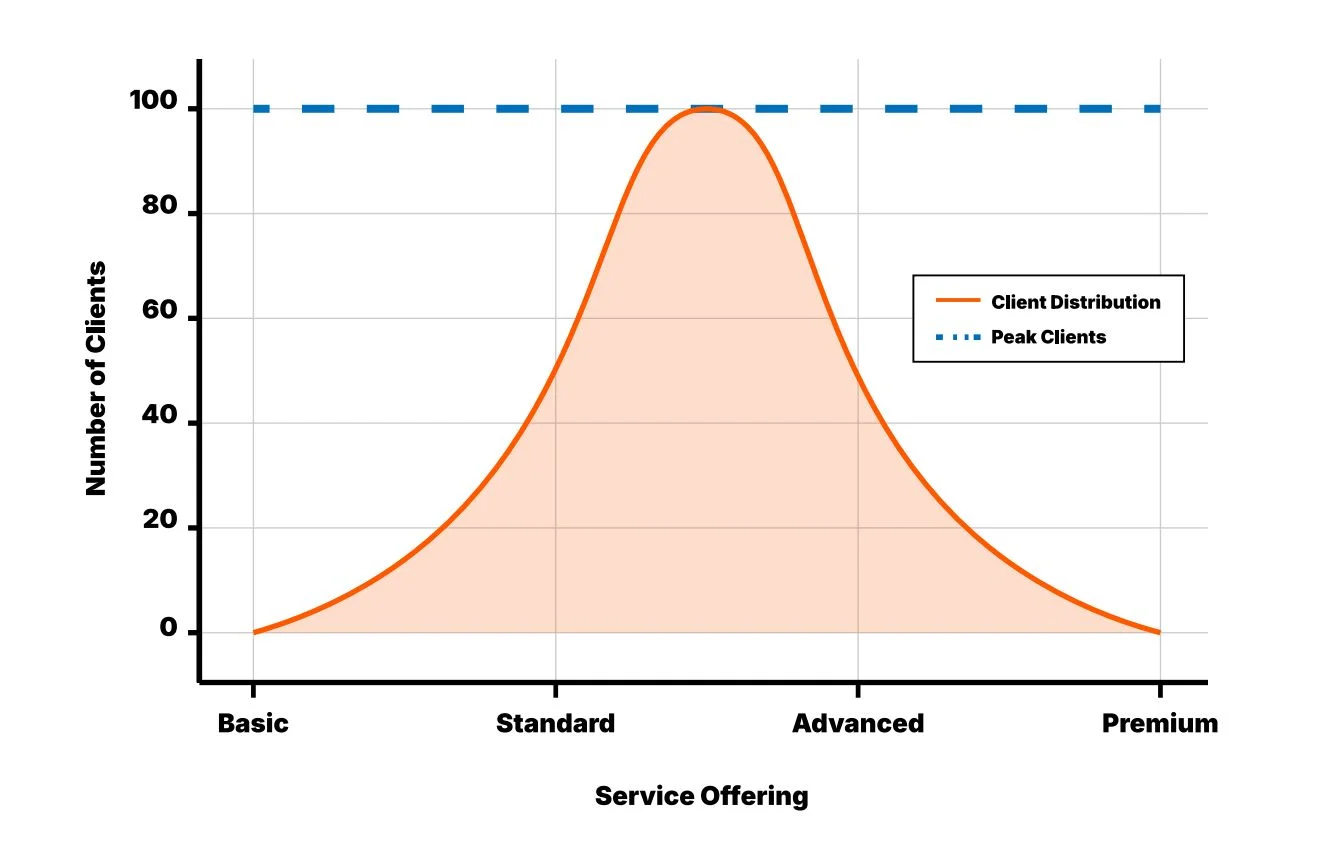

The Goldilocks Zone

This zone ensures that you have a well-balanced distribution of clients across tiers. Your team is working at the right level of intensity per tier, and you’re maintaining healthy margins.

When building or adjusting fees, consider:

- Balanced distribution is key: Avoid overconcentration in one service tier.

- Pricing drives behaviour: If too many choose Premium, you may be undercharging.

- Sustainable profitability: Profit should span all tiers.

- Market segmentation works: Tiering helps meet diverse client expectations.

- Optimal pricing strategy: Keeps demand distributed.

- Avoiding extremes: A skewed client mix may indicate mispricing.

Pro Tip: Don’t forget hidden costs like chasing receipts or fixing incorrect categorisation — they add up fast and eat into profit.

Communicating pricing changes

Changing your pricing? Don’t just send a new invoice. Make sure clients understand what’s changing and why:

- Show how the scope of work has evolved

- The added value you now provide

- Communicate early and give clients time to ask questionsOptions or flexibility (tiers help soften the impact)

Pro Tip: Use visual aids or checklists in your comms — showing the "before and after" is more persuasive than telling.

Want more help with client conversations? The full Pricing Guide PDF includes objection-handling templates, sample email scripts, and more to help you communicate pricing changes with confidence. → Download the full PDF

Conclusion

Getting ready for MTD ITSA doesn’t have to be complicated. With the right pricing strategy, clear service tiers, and well-communicated changes, your firm can stay profitable while delivering real value.

Use this pricing guide to set expectations, align your team, and roll out a model that works – for you and your clients.

Prefer a printable version?

Download the PDF pricing guide — includes objection-handling scripts and email templates to handle client comms.

Want to go deeper?

Explore the Make Tax Digital guide for full timelines, pricing advice, and rollout tips tailored to accounting and bookkeeping firms.

Looking for the right software?

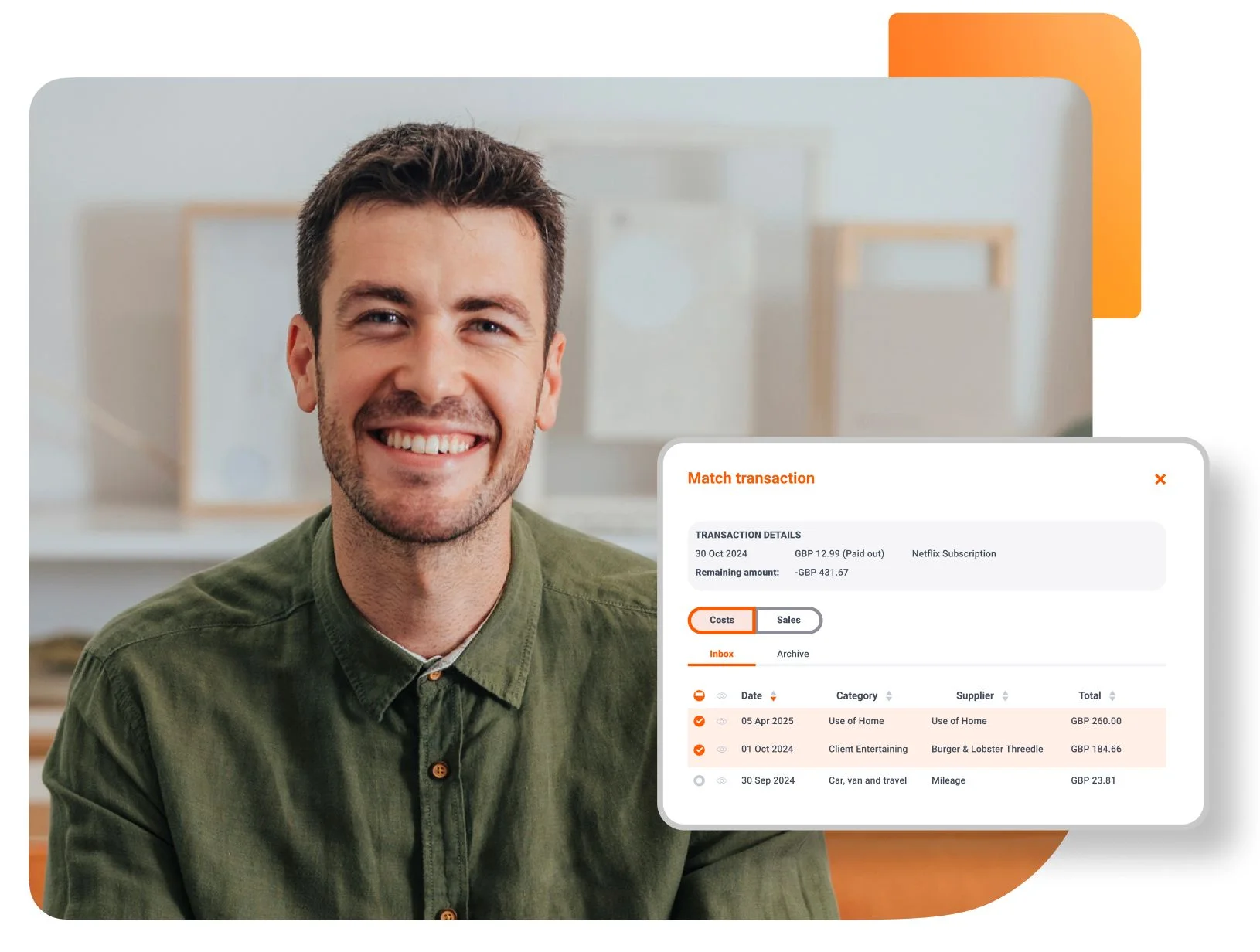

Our MTD software Dext Solo helps you streamline submissions, reduce admin, and stay confidently compliant — one client at a time. Now also available in our mobile accounting app.

Ready to go deeper?

Master MTD for 2026 with our most-read resources, packed with expert insights, practical advice, and next steps for your firm.

Dext’s HMRC-recognised

MTD software

Dext Solo is a digital record-keeping solution built to help you manage MTD for Income Tax and quarterly updates. We handle the hard part: getting accurate data in, fast and at scale. It’s easy to use and works with your preferred finalisation software or on its own.