Make MTD IT Easy:

Your 6-Step Cheat Sheet

Get prepared for MTD IT with actionable tips,

and learn how the right MTD software can make it even easier.

Download our MTD Cheat Sheet

6 things firms should be thinking about ahead of April 2026

MTD is coming. Are you ready? April 2026 may sound far off, but the real prep starts now. If you’re not sure where to begin, you’re not alone. That’s why we’ve broken it down into 6 clear, practical steps to help you stay ahead, stay compliant, and support your clients with confidence. Let’s get started.

1. Segment your clients now

Not all clients are created equal. Prioritise the ones who need help first.

Start by identifying which clients are over the £50,000 threshold and will be impacted by MTD ITSA in 2026. Then assess their digital readiness:

- Who already uses software?

- Who needs more hand-holding?

- Who may resist change?

Segmenting now lets you plan your rollout, prioritise communication, and avoid last-minute surprises.

Pro Tip: Start with a small test group to trial your workflow before scaling across your full portfolio.

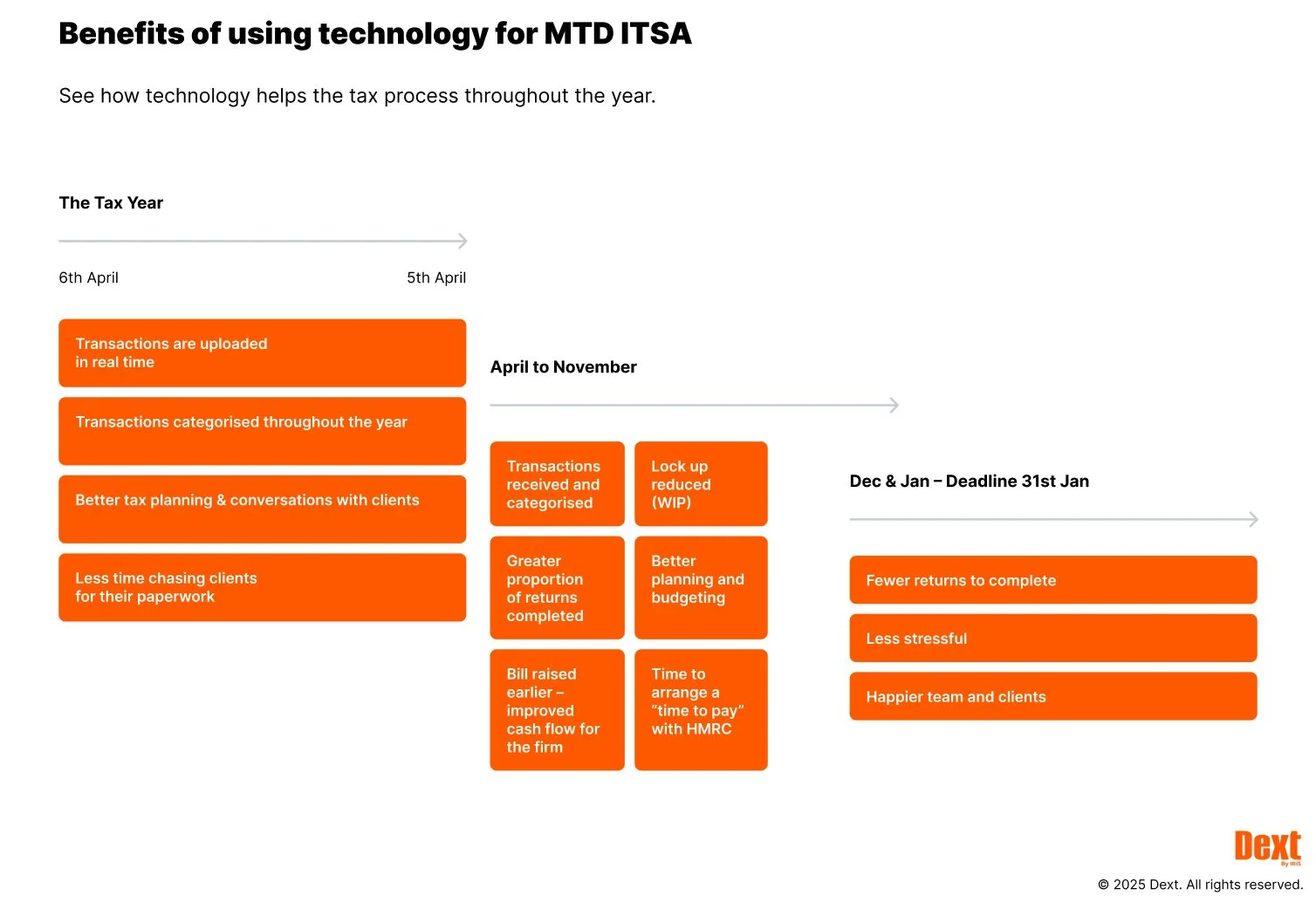

2. Set up smarter data collection

Quarterly reporting means you need cleaner, faster access to client data all year round.

The challenge isn’t just filing more often, it’s collecting reliable records on time. MTD IT will require clients to submit income and expenses every three months. That means:

- No more digging through inboxes

- No more January chaos

- No more missing receipts

Start shifting clients to real-time habits now. Tools like Dext Solo help you collect, categorise, and prepare digital records automatically — saving hours and reducing risk.

Pro Tip: The earlier you automate collection, the easier MTD IT becomes.

3. Revisit your pricing model

Quarterly reporting = more touchpoints. Don’t underprice the new workload.

MTD ITSA shifts clients from once-a-year to five-times-a-year submissions. That changes your scope of work — and your pricing should reflect it.

Consider:

- Tiered service levels (DIY vs. managed)

- Advisory add-ons like forecasting or cash flow planning

- Internal time costs for review and reconciliation

Clients will get more value. You should too.

Pro Tip: Transparent, early communication about pricing changes builds trust , not friction.

4. Clean up client bank workflows

If clients don’t separate business and personal finances, now’s the time.

Private landlords and sole traders often mix accounts, making it harder to code transactions accurately. That slows you down and risks non-compliance.

Encourage clients to:

- Open dedicated business accounts

- Tag transactions as they go

- Use software that supports cash coding clean-up

MTD is a great moment to reset bad habits and establish new expectations.

Pro Tip: Dext Solo makes it easy to flag disallowables and tag expenses clearly before submission time.

5. Align your team early

MTD isn’t just a tax change. It’s an operational shift.

Who owns what? Who’s client-facing? Who needs training?

Define roles now:

- Assign an MTD lead or champion

- Upskill client managers on the new process

- Communicate the rollout timeline internally

And don't forget: technology adoption starts from within.

Pro Tip: Simple internal process maps or checklists help keep everyone aligned , especially during busy periods.

6. Choose software that scales with you

Pick tech that’s made for MTD IT, not hacked for it.

MTD isn’t a one-time change. It’s a long-term shift toward digital recordkeeping and real-time tax compliance.

Choose tools that:

- Are HMRC-recognised

- Work well for sole traders and landlords

- Support automation, collaboration, and clean handoffs to your tax software

Don’t let poor tech hold you back or confuse your clients.

Pro Tip: Need a place to start? Explore how Dext Solo is the most efficient MTD IT software

MTD IT Timeline

April 2026 is closer than you think – and every phase of the rollout matters.

HMRC is phasing in MTD for Income Tax over several years, starting with clients earning over £50,000, followed by those earning over £30,000. But eligibility is based on income from two years prior, meaning decisions made now directly affect who’s in scope.

This timeline helps you visualise the rollout and plan your communication, software setup, and pricing changes before deadlines stack up.

Today

While MTD for IT is not yet mandatory, HMRC is encouraging firms to make a start now. Voluntary participation is open, which is a great way to trial new processes and systems before the legislation is made official.

April 2026 - Initial Rollout

The initial phase of MTD for IT – for sole traders and landlords with taxable income above £50,000 per annum (p.a.) – will come into play in April 2026. From this point onwards, those clients will have to keep digital records and submit them every quarter.

April 2027 - Phase Two

A year later, the threshold of £50,000 p.a. will be lowered to £30,000, potentially extending the legislation to more of your clients. Please bear this in mind when introducing any new processes and systems.

April 2028 - Phase Three

From 6 April 2028, the threshold will be reduced to £20,000. Whether a client exceeds will be tested based on 2026/2027 return.

MTD IT Checklist 2026

Now that you’ve nailed the 6-step plan and timeline, it’s time to move.

This checklist breaks it all down so you can take MTD one clear, confident step at a time. From client segmentation to software setup and team alignment — it’s all here, ready to guide your rollout.

Segment your clients: which clients does it affect?

Prioritise your clients: whom will it affect most?

Engage your clients – make sure it’s on their radar

Review your current process – where might things come unstuck?

Research software options – consider scalability and existing systems

Implement chosen software – be patient, this may take time

Onboard and upskill your team – delegate and share this task

Build a clear communication plan – think internally and externally

Test and refine your new process – do this internally before it goes live

Adjust pricing model – you may also need to revisit any letters of engagement

Conclusion

Getting ready for MTD ITSA doesn’t have to be complicated. With the right clients, systems, and internal alignment, your firm can turn this compliance shift into a growth opportunity.

Use this cheat sheet to simplify conversations, align your team, and build momentum ahead of April 2026.

Prefer a printable version?

Download the PDF cheat sheet — includes all 6 steps plus a bonus planning checklist.

Want to go deeper?

Explore the Make Tax Digital guide for full timelines, pricing advice, and rollout tips tailored to accounting and bookkeeping firms.

Looking for the right software?

Our MTD software Dext Solo helps you streamline submissions, reduce admin, and stay confidently compliant — one client at a time. Now also available in our mobile accounting app.

Ready to go deeper?

Master MTD for 2026 with our most-read resources, packed with expert insights, practical advice, and next steps for your firm.

Dext’s HMRC-recognised

MTD software

Dext Solo is a digital record-keeping solution built to help you manage MTD for Income Tax and quarterly updates. We handle the hard part: getting accurate data in, fast and at scale. It’s easy to use and works with your preferred finalisation software or on its own.