Effortless payments. All in Dext.

Manage client payments with confidence from one place - from invoice capture to approvals, payment runs and reconciliation.

Less admin. Faster approvals. Payments you can trust.

No credit card required.

2023 Winner - ‘ Best Accounting Cloud-Based Software Company’

2024 UK Winner - Xero small business app of the year

2024 US Winner - Xero small business app of the year

Why manage payments in Dext?

Managing payments often means switching tools, keeping track on spreadsheets and chasing payments approvals on email.

Payments in Dext connects everything together in one place, so you can pay with confidence.

Run payments from one platform

Keep invoices, approvals, payments, and reconciliation connected — reducing admin and giving you full visibility at every step.

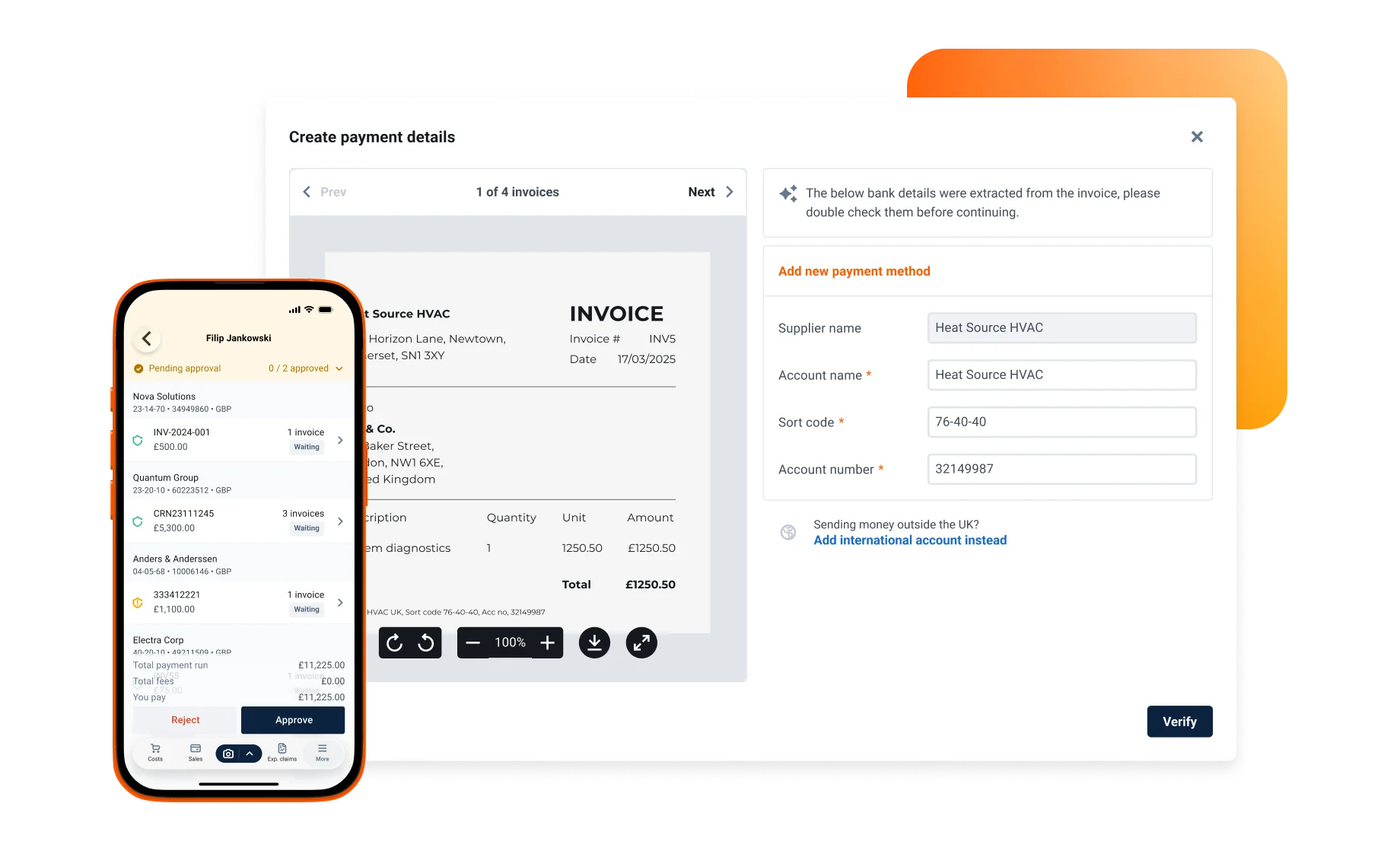

Get sign-off

faster

Built-in approval workflows make it easy to get the right confirmation from your clients quickly, without long email chains or follow-ups.

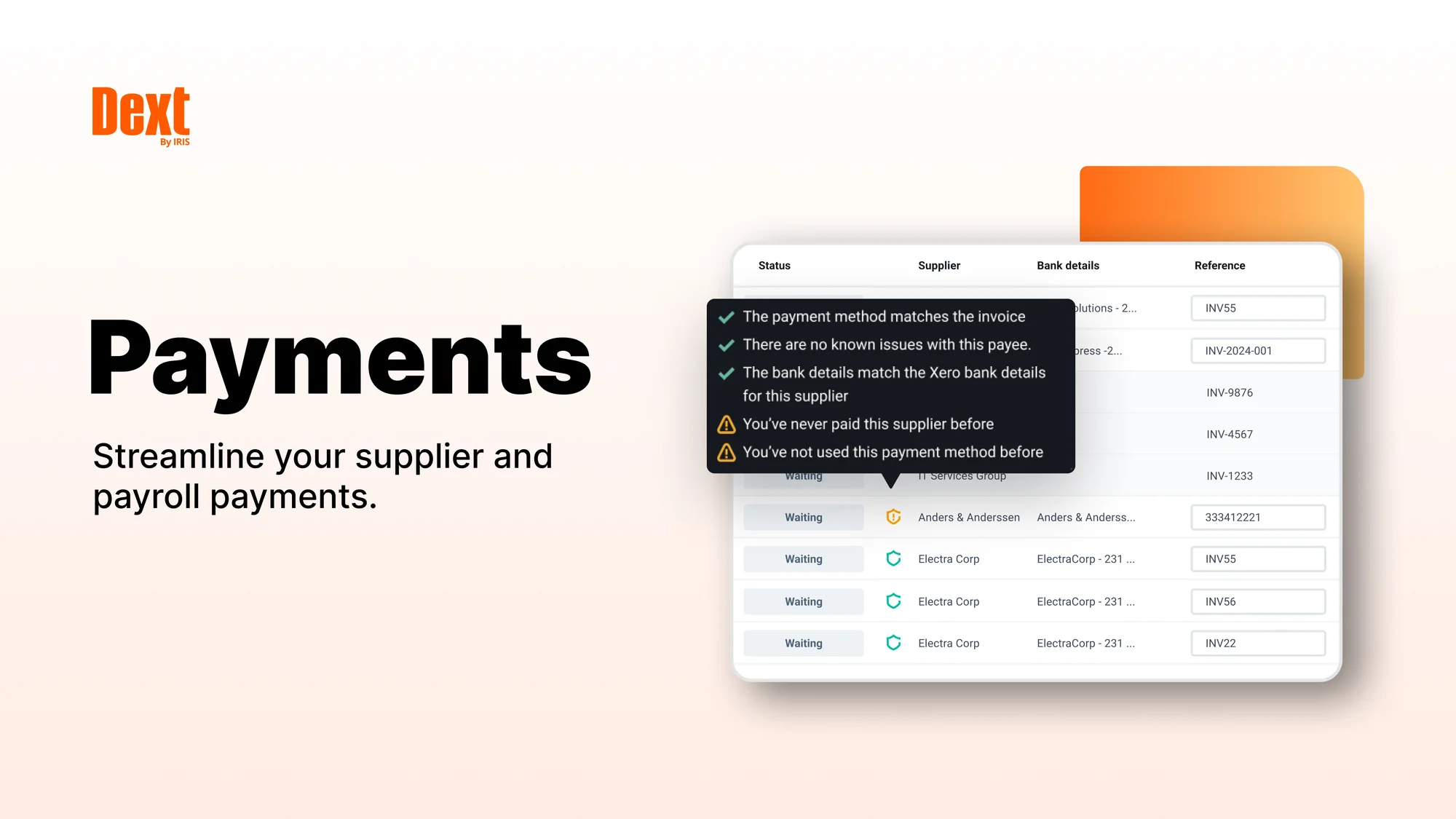

Pay suppliers in minutes

Make payments in a few clicks, including batching multiple invoices from the same supplier into a single payment run.

Reconcile without the manual work

Payments sync automatically with your accounting software, eliminating re-keying and reducing errors.

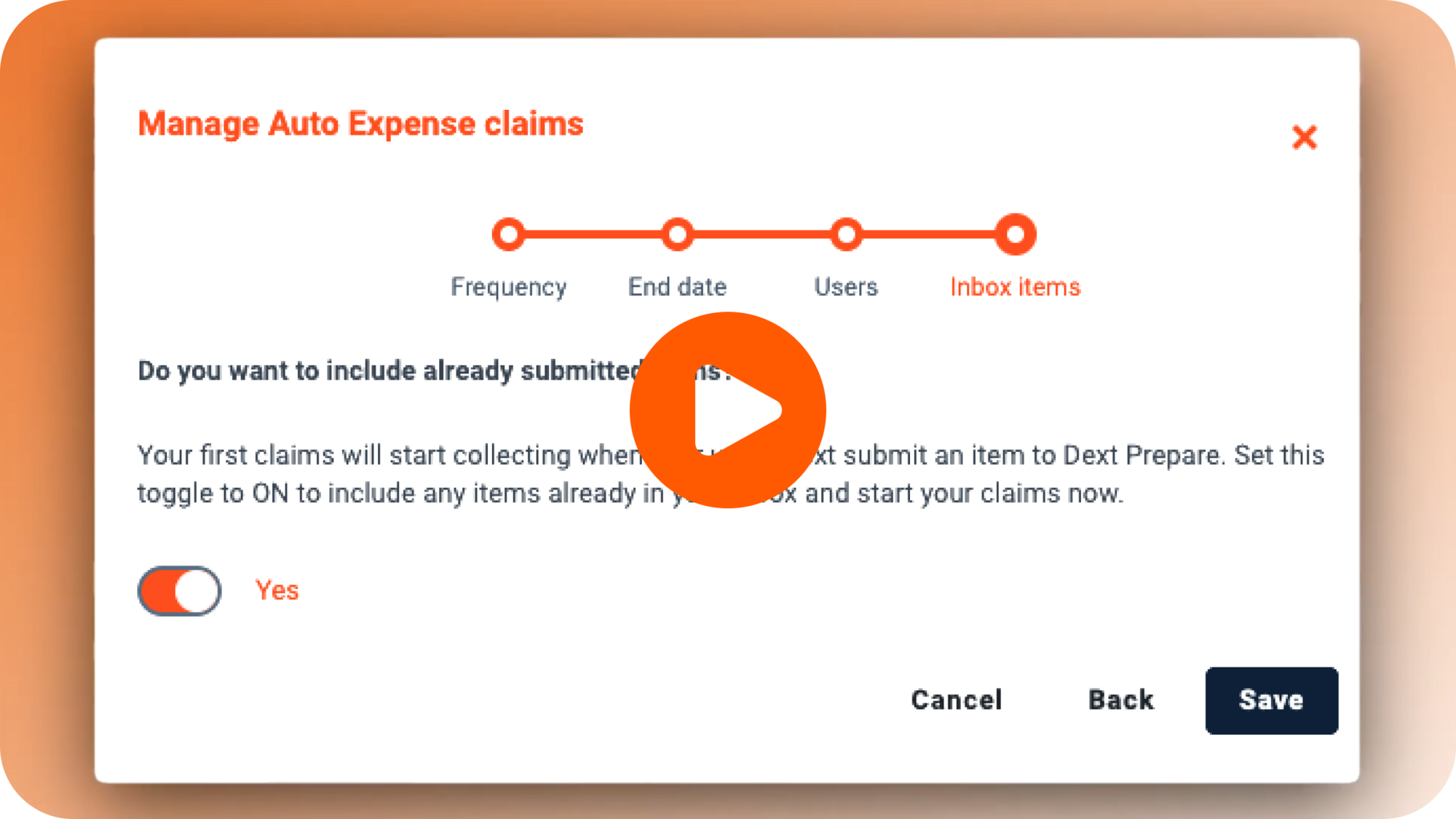

See how payments work

Explore a smarter, simpler way to manage outbound payments from invoice to payment and reconciliation.

Watch the product tour.

Book a consultation call so our team can walk you through Payments in Dext.

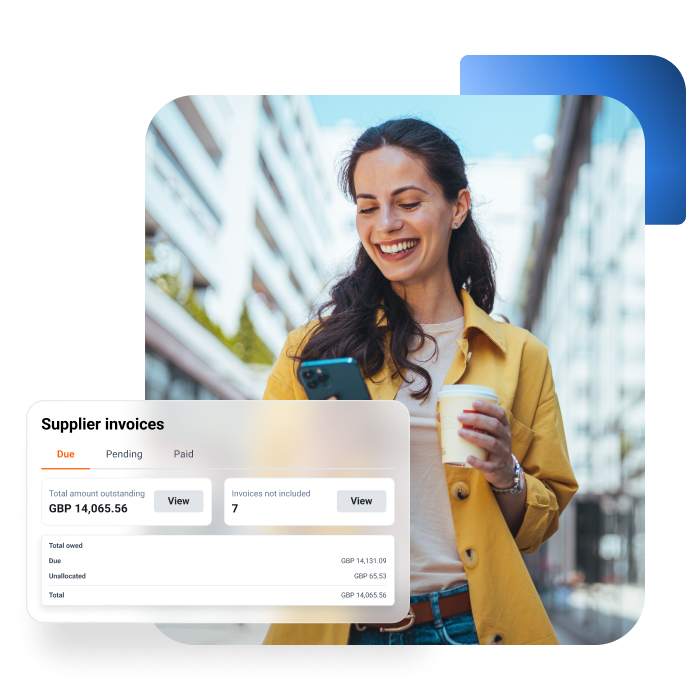

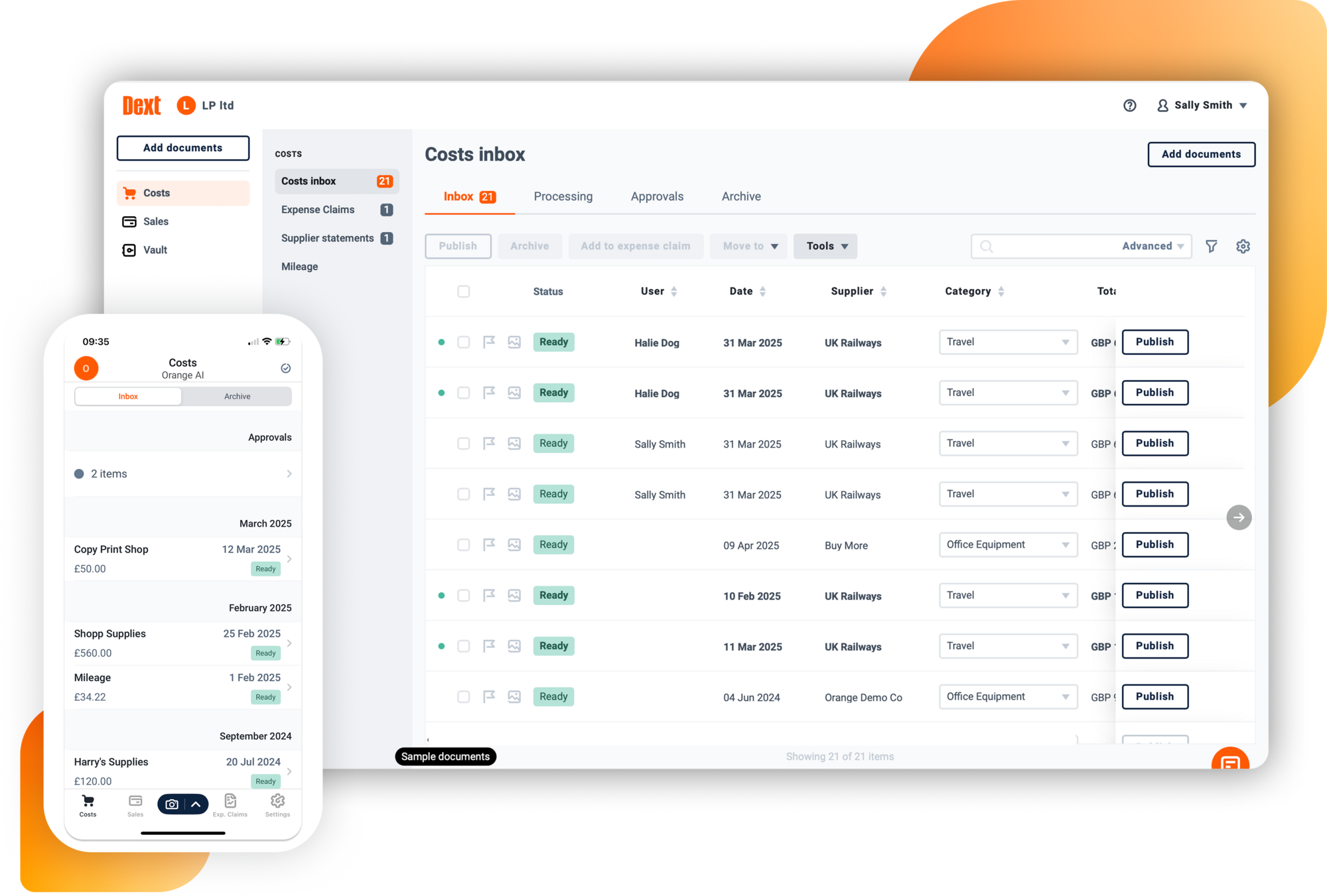

Manage payments in one place

From invoice upload and expense creation to approval and secure payment. You can do it all in Dext.

Pay supplier invoices directly from Dext, individually or in batches

Pay employee expenses directly from Dext

Run and reconcile payroll payments (coming soon)

Please note Dext Payments is currently only available for Dext customers using Xero. More integrations will be available soon.

Built with

accountants

in mind

Whether you already manage client payments or want to start offering payments-as-a-service, Dext makes it easy to deliver a secure, approval-led payment service from one place.

No bank access required

Manage the payment process without logging into client bank accounts.

Less chasing, more advising

Reduce payment delays and free up time for higher-value work.

Security at every step

Built-in checks help you pay with confidence.

Scale without scaling admin

Offer payments as a value-added service without increasing headcount..

Join thousands of firms who rely on Dext

Businesses globally

Accounting and bookkeeping firms

Business documents processed annually

CUSTOMER TESTIMONIAL

“Before Dext Payments, I could keep clients’ ledgers up to date. But actually getting invoices paid often meant reminders, chasing, and extra admin. Now I can initiate payments as part of my weekly workflow, with clients still in control through simple approvals. It reduces complexity, saves time, and gives both me and my clients real reassurance that everything is paid properly; and suppliers stay informed too".

Jane Rasquinha, founder of Digital Advisory Bookkeeping

We are here to help

Our support service answers your technical questions by chat or email and offers you valuable advice to support your digital transition.

customer satisfaction rating (NPS)

48 hours

average time to our first response

+ 250 tutorials

available on our Help Centre

Resources

Practical advice on how to introduce payments to your practice

Learn more

Watch how-to videos

Our experts introduce you to our new integrated payment solution.

View Pricing

See what it would cost to manage payments in Dext

DextU training modules

Learn how to setup and make payments from your Dext account.

Expert advice

Explore our how to articles and help centre to find the answers to your questions.

Dext Payments is enabled through a partnership with Airwallex (UK) Limited, authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN 900876). All regulated payment and electronic money services are provided by Airwallex (UK) Limited.

Ready to simplify how you pay?

Over 700,000 businesses and 12,000 bookkeeping and accounting firms worldwide use Dext to make more time for the things they do best.

Want to talk it through?

Ready to try Payments?

Log in to your existing Dext account and add payments to your workflow.

Frequently Asked Questions

Yes. Dext Payments is enabled through a partnership with Airwallex (UK) Limited, authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN 900876). All regulated payment and electronic money services are provided by Airwallex (UK) Limited. In addition Dext also has robust security features in place such as protective fraud shields to help prevent fraud and secure approvals and Strong Customer Authentication (SCA) to ensure only authorised users can make payments. You can read more on security and compliance here.

Dext Payments is designed for accounting and bookkeeping partners who want a simpler way to help clients manage payments.

What types of payments can I make?

You can make:

- Supplier payments (Accounts Payable)

- Employee expense payments

We will also be adding Payroll payments very soon.

Dext Payments is priced at £10 per client per month which includes 20 supplier payments and 20 payroll payments. Additional payments are priced at £0.25 per transaction. You can see more details here.

Yes. If you’re paying multiple invoices to the same supplier and bank account, you can group them into one payment. You’ll only be charged once (not per invoice like other solutions), and each invoice will be marked as paid and reconciled.

Yes. Dext Payments integrates with Xero, helping keep your payments and bookkeeping aligned for easier reconciliation. We will be adding Quickbooks Online integration in the coming months.

Yes. Once the payment is made, the invoices linked to that payment will be marked as paid to help keep your records up to date.

Yes. Dext Payments integrates with Xero to help keep payments and bookkeeping in sync and make reconciliation faster. We will also be adding a QuickBooks Online integration.

Yes. You can use Dext Payments to offer an end-to-end Payments as a Service solution - so clients stay in control of approvals while you manage the operational steps.

No. Dext Payments helps you run payments without needing access to a client’s bank account, making it easier to separate responsibilities and reduce risk.

You can access Dext Payments directly within your Dext account. Read our Getting started guide to walk you through the setup process.