What does the Autumn Budget 2024 mean for accountants and bookkeepers?

A ‘Budget for the ages’. That was the billing for Chancellor of the Exchequer, Rachel Reeves’s first Budget announcement. And, while there were few optimists ahead of the forecast, the Chancellor's decision to raise £40 billion in taxes certainly raised eyebrows throughout the House of Commons and up and down the country.

Politics aside, the government’s Budget will have clear implications for businesses – namely those small-to-medium sized – across the UK. Like any Budget announcement, those business owners will now turn to their accountants or bookkeepers to help them navigate the next steps.

In this blog, we’ll be summarising all of the key talking points from the Budget, and provide clear guidance on what this means for accountants and bookkeepers and their clients.

Highlights from the Budget

Before we look at the impact the Budget might have on you and your firm, let’s take a look at some of the key takeaways. In short, the Budget promises to ensure stability and growth through a mix of spending cuts, tax increases, and targeted investments in key sectors. Here are some of the key points for each audience.

Businesses

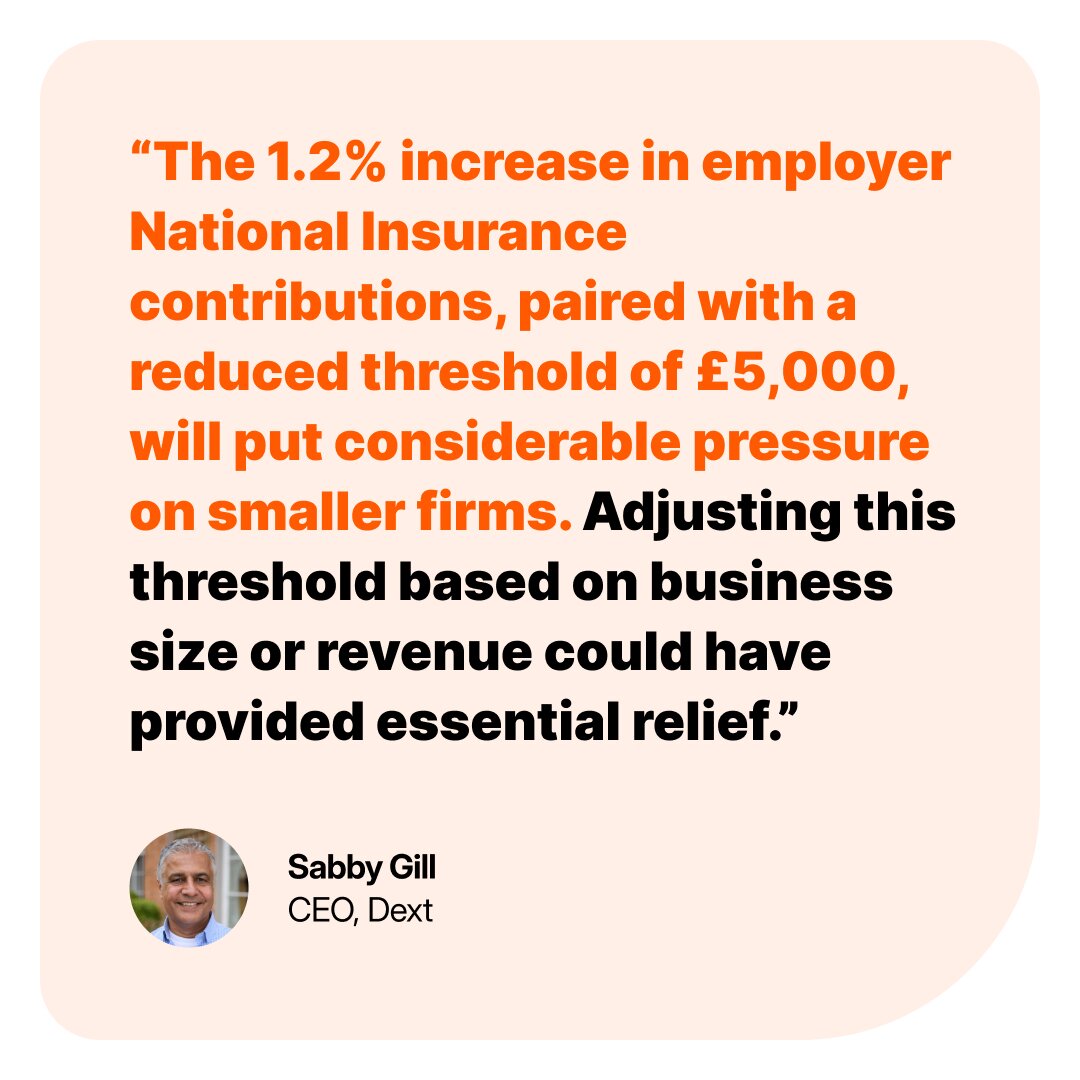

Small-to-medium-sized businesses will face a number of new challenges. Employers are set to raise close to £25 billion of the total £40 billion through Employers National Insurance payments, and with increased national minimum and living wages, many will be forced to rethink how they recruit and manage employees.

Of course, these additional costs will force businesses to reassess in an attempt to mitigate the significant cost they’re set to absorb. And there are already early concerns over a potential increase in the number of non-payroll employees.

- National Living Wage and National Minimum wage to increase by 6.7% to £12.21 per hour from 6 April 2025

- Employer NI: Increase to 15% and cut the Secondary Threshold to £5,000 until 5 April 2028

- Employment allowance to increase from £5,000 to £10,500 and remove the £100,000 Employment allowance eligibility threshold - 5 April 2025

- Extend 100% FYA for zero emission cars and charging points to 31st March 2026

- The current 75% discount to business rates - due to expire in April 2025 - will be replaced by a discount of 40% - up to a maximum discount of £110k

- Corporate Tax Roadmap – commits to capping the Corporation Tax at 25%, maintaining key tax features and rates, and exploring improvements in tax processes and administration

Individuals

The government has stuck to its manifesto by maintaining PAYE and NI (besides the increase to Employers NI). However, there were some surprises on things like Capital Gains Tax and Agricultural property relief.

- No changes to PAYE or Employees NI (as expected). No changes to Self Employed NI

- Abolition of non-domicile status and introduction of a residence-based regime from 6 April 2025

- Capital Gains Tax: Increase the main rates of CGT to 18% and 24% from 30 October 2024

- Business Asset Disposal Relief (BADR) and Investors’ Relief (IR) rate to 14% from 6 April 2025 and to 18% from 6 April 2026

- Investors Relief lifetime limit reduced from £10 million to £1 million from 30 October 2024

- Agricultural property relief and business property relief will be reformed from 6 April 2026 (relief reduced from 100% to 50%)

- Inheritance Tax: Unspent pension funds and death benefits payable from a pension will be included in the value of estates from 6 April 2027

- SDLT – increasing the rate on the purchase of second homes, buy to let properties and companies purchasing residential property by 5% from 31st October 2024

- State pension & Pension credit uprated by 4.1% from April 2025

- Carried interest CGT rate increased to 32% from 6th April 2025. From 2026 carried interest will be fully taxable within the income tax framework

What else?

The Budget was packed full of both the expected and unexpected. VAT on private school fees – a hot talking point in the press in recent months – is going ahead as planned. There are also further administrative changes for tax practitioners, and additional funding to recruit HMRC compliance officers and debt management officers. This is largely down to the fact that HMRC believes there is ‘cash to collect’, which would explain further investment into counter-fraud capacity.

- VAT on private school fees continues as planned from 1st January 2025

- Removal of business rate relief for private schools from April 2025

- Modernising and mandating registration of tax practitioners interacting with HMRC from April 2026

- Continued plans to modernise HMRC systems

- Increase interest rate of 1.5 percentage points on unpaid tax debts from 6th April 2025

- EIS and VCT schemes extended to 2035

- Company cars: Increase in BIK rates set for 2028-29 and 2029-30

- The reporting of BIK will have to be via payroll software from April 2026

What impact does the Budget have on MTD for ITSA?

In the context of MTD for ITSA, there are few updates. The only major announcement was that the income threshold will be lowered to £20,000; when that will come into play is still to be decided. Of course, this will bring more individuals under the mandate. Accountants and bookkeepers must be prepared to answer a range of questions.

The good news is that in the forecast there is a clear commitment to MTD for ITSA and the modernisation of HMRC’s systems. Based on that, firms can expect little to no disruption in the run-up to April 2026 (we hope).

- Quarterly updates and deadlines are the same for each client

- Real-time data collection will be critical

- Proposal to lower the threshold to £20,000. Dates TBC

- Tax records for 24/25 will determine who is legally required to join (you may already know)

- 25/26 due Jan 27. Quarterly updates 26/27 run alongside - Real Time Data Collection

- No date has been confirmed for Partnerships or Limited Companies

What does the Autumn Budget mean for accountants and bookkeepers?

The Budget brings a mix of adjustments that accountants and bookkeepers must address as they help small businesses navigate rising costs and new financial reliefs. Notably, the adjusted employer National Insurance threshold, dropping from £9,100 to £5,000, will affect cash flow, along with the increase to National Minimum Wage. Although the increase to the Employment Allowance will provide some relief for smaller businesses.

The extension of the Enterprise Investment Scheme provides vital growth opportunities for businesses. However, the increase in the CGT rate relating to Business Asset Disposal Relief may impact entrepreneurship. In addition to this, the Government’s plan to expand Making Tax Digital for Income Tax Self Assessment to those with incomes above £20,000 signals a deeper commitment to digital transformation.

Accountants can support clients through this shift, as well as assist with the upcoming e-invoicing consultation, aimed at establishing standards and boosting adoption. Ultimately, in today’s climate, automation and AI-driven tools are essential for accountants to manage these changes efficiently. By streamlining manual tasks and offering timely insights, technology allows them to provide strategic, data-driven guidance; keeping small businesses resilient and prepared to meet evolving demands.

If you’d like to learn more about how Dext can support you and your clients through these challenges, we’d love to hear from you. Click below to find out more.