Why Ensuring Data Quality is More Important Than Ever Before

Working with up-to-date, accurate and reliable financial data is always important. But in times of economic uncertainty, it can mean ‘make or break’ for your clients. Data quality impacts the decisions your clients are able to make about the future of their business. It also affects the level of insight and recommendations your firm can provide, as well as how profitable your firm can be from the services you offer.

So as your clients’ trusted accountant/bookkeeping partner, it’s time to make data quality a priority.

What is data quality and why is it important for accounting firms?

Data quality is a measure of the accuracy, completeness, uniqueness, consistency, and validity of the data set, which is all the gathered information you’re working with. Data timeliness is another important measure of data quality, as up-to-date and accessible data is the lifeblood of any business. In accounting technology, data quality also depends on measuring data integrity and data security.

Data quality metrics:

- Data accuracy - are the records error-free and consistent with reality?

- Data completeness - what percentage of the required dataset is currently available?

- Data uniqueness - does the data appear once in the data set, or is it duplicated?

- Data consistency - is the data uniform in each application that it is stored or viewed in?

- Data validity - how is the data stored and formatted, and can the data source be trusted?

- Data timeliness - is the data up to date, available and accessible when needed?

- Data integrity - are there effective data processes in place to assure the quality of data over its lifecycle?

- Data security - is the process of appropriately storing data in place throughout its lifecycle?

Data compliance is not a typical data quality dimension, however it is vitally important. Particularly in accounting and other industries with strict data standards which govern the possession, organisation, storage and management of data. So your data quality strategy should cover all accounting and financial data being stored and shared in compliance with any standards that both the firm and the client need to adhere to for legal or regulatory reasons.

Why is data quality management so important for accounting firms and their clients?

Download our latest guide to find out more.

Accurate and timely financial data that paints a ‘full picture’ of business health, gives your clients the confidence that they are acting on the best available information. Good quality data is also the foundation for cash flow forecasts and management reporting, which helps drive business decision-making. Improving data quality also helps to reduce costs, both in terms of time spent data processing, and business funds wasted on unnecessary or ill-advised spending.

This is why forward-thinking accounting practices are helping their clients to manage-out the risk of bad data, using automated accounting software. Automation can be applied to most stages of the accounting cycle and is proven to improve data quality, as the risk of manual errors is drastically reduced.

Why should good data quality be a top priority in times of economic uncertainty?

In times of economic uncertainty, businesses of all shapes and sizes may find themselves having to navigate three major challenges:

- Inflation and higher costs. Rising rents, utilities and wages are driving up the cost of doing business.

- Cash flow issues. Poor cash flow can result in an inability to pay bills on time, which can quickly lead to insolvency.

- Supply chain insecurities. Upstream and downstream volatility makes over-reliance on a particular supplier or customer very risky.

So it’s especially important in turbulent times for accountants to help clients stay ahead of their numbers. That way, they can provide advice based on robust and reliable data. Depending on your client’s reserves, they may need to raise prices, cut costs, transform business practices or re-organise supply. None of these things are necessarily bad for business - but understanding the short and long term impact of their decisions is essential.

The first step to ensuring clients have good data quality to support decision-making is to automate data capture, processing, analysis and reporting. The next step is to make this data visible to you, and your client. If your current systems do not make it easy to access real-time information then it’s time to consider your options.

Visible and real-time data is key to driving regular conversations with your clients. It will help stop your clients burying their heads in the sand when it comes to their financial performance. Instead, they will be able to see and address early warning signs of hardships.

With robust data management processes and technology in place, you will be able to monitor leading indicators and help them identify financial risks before they become an issue. Some of the areas affected might include:

- Cashflow

- Debtors day trends

- Bank balances

- Net Assets

- Liabilities

- Ability to pay creditors as they fall due

- Directors funding trends

- Loans, credit cards and finance

- Debt-to-equity ratios

- Reliances on particular customers/suppliers

Data quality management tools to add to your accounting stack

The benefits of high-quality financial data to your clients’ businesses are clear. But real-time financial data insights are extremely difficult to achieve manually.

A recent survey found that currently:

- Accountants spend nearly 5 hours each week checking inaccurate data from clients;

- One in every eight hours is spent manually looking for data errors;

- The hours spent removing duplicate data and data cleansing is actually 3 more hours than estimated;

- A firm of 15 accountants and bookkeepers will spend 3,284 hours annually on bad data.

As much as 40% of the time spent manually retrieving, resolving and reporting on clients’ data could be saved with automated data quality management tools. With the right accounting technology stack in place to improve data quality management, your firm can ensure insights are accurate and easy to come by. And that they can be served up, profitably, to clients, when they need them.

Automation can also help accountants catch errors before they get out of control. One mistake can build and can cause habitual errors, damaging your data in the long term. Such errors can take a long time to fix and affect your firm’s recovery rates - which is why accounting and pre-accounting software are designed to highlight inaccurate data and inconsistencies for your investigation.

Automating data capture, processing, analysis and reporting for end-to-end financial processes requires a range of solutions. Key to joining up the data is choosing solutions that integrate with the tools you already have in your tech stack.

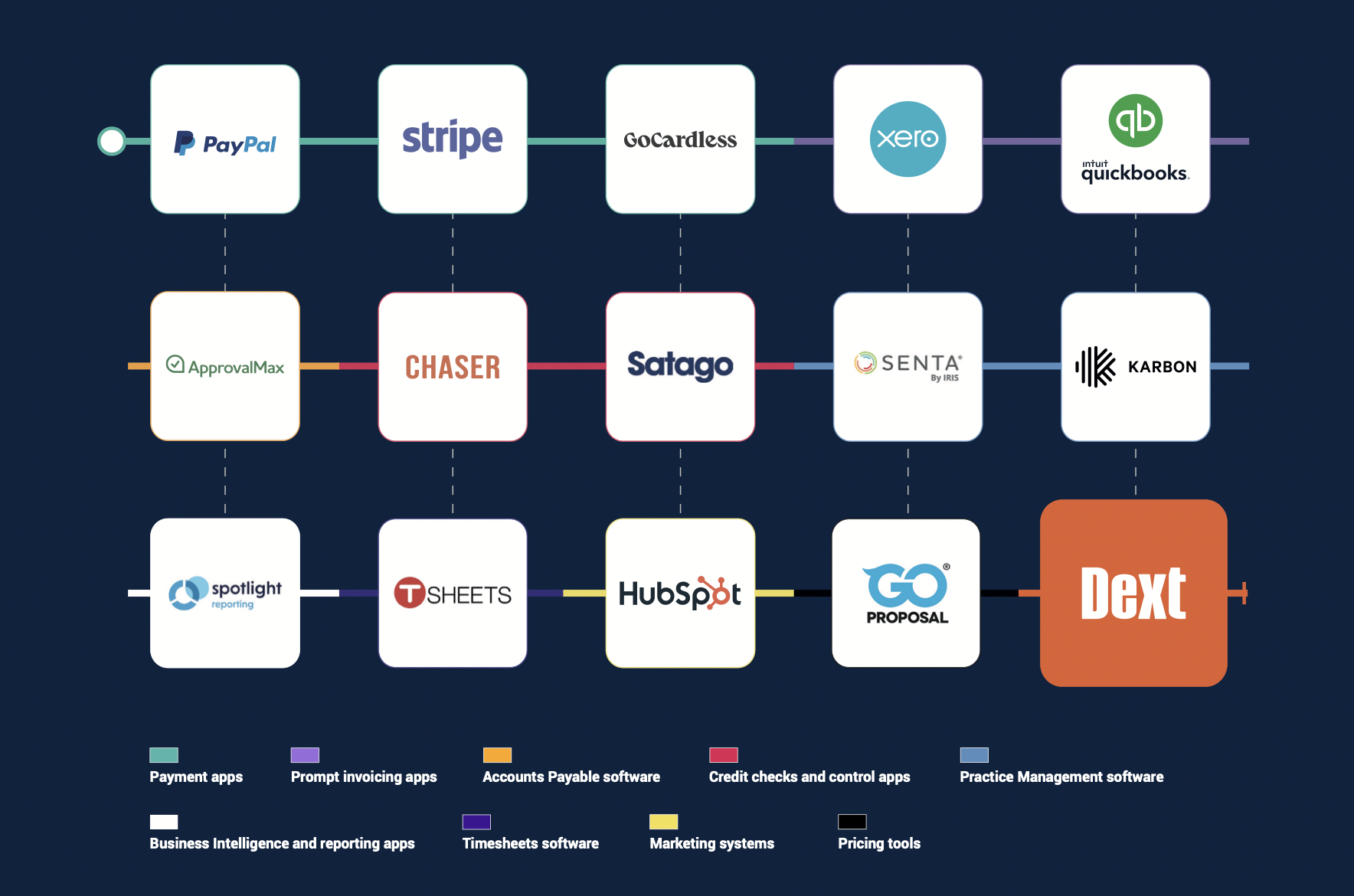

Dext Precision is the most integrated solution on the market. It will improve your data quality in systems like Xero and QuickBooks, and it can also integrate or compliment other apps and software that your clients (or your practice) may use, including:

- Payment apps

- Prompt invoicing apps

- Credit checks and control apps

- Accounts Payable software

- Practice Management software

- Business Intelligence and reporting apps

- Timesheets software

- Marketing systems, and

- Proposal writing tools

How to improve data quality for each of your clients

Paperwork, manual data entry, and manual data cleansing are some of the most common causes of bad data. So to improve data quality, it’s important to understand your clients’ data management processes. And wherever possible, to automate them. If financial data is automatically retrieved from the data source and posted to your chosen accounting software, it significantly reduces the risk of errors. It also saves you and your client a significant amount of time.

But not all pre-accounting tools are made equal. So it’s important to invest in software that is proven to ensure data accuracy to improve data quality:

Dext Prepare collects and extracts your paperwork with 99% accuracy. It offers a fast and simple way to bring all your clients’ paperwork together in a standardised, digital format. Your client simply takes a photo or emails their receipt, invoice or bank statement and uploads it to Prepare. They can even set up direct data feeds to completely automate the process. Prepare then extracts the data needed and sends it to your chosen accounting software - so you get the accurate numbers you need, without the risk of human-error impacting data quality.

Dext Precision then takes all of the data you or your client have fed into Xero or QuickBooks Online and alerts you to any discrepancies, so you know you’re always starting from a place of accuracy. Plus, it’s loaded with features to improve insights, workflows and more.

Even after automating pre-accounting tasks to improve data reliability, it can still be difficult for accountants to measure data quality for each one of their clients. But the Practice Insights dashboard in Dext Prepare is a game changer: it allows you to check the financial performance of your clients quickly and efficiently. It also visualises all your ‘client action’ data points and workflows in one place, helping you easily monitor other client actions that could impact data quality such as:

- Less communication with you/your team than usual;

- An increase in the length of time it takes to respond to your data requests;

- Poor or missing data and records.

These are also indicators that your client may be facing financial challenges that you could help them address.

How investing in data reliability can help clients through periods of uncertainty

With the right systems and processes in place, high-quality, complete data sets are now achievable for most businesses. And this means better recoverability and power to offer more value to your clients at every engagement. This is especially important in times of economic uncertainty when your clients may need your help with certain challenges. For example:

Cash flow improvement strategies

There are many ways to improve cash flow, not all of which will be relevant for every client. Data quality is likely to determine which strategy you are able to advise on. You need reliable data in order to analyse the opportunity for improvement, which will inform where your client should focus their efforts. The following initiatives are all things you can discuss with your clients to help invigorate their cash flow and protect their reserves:

- “Lease, don’t buy” initiatives

- Credit checking services

- Immediate invoicing processes

- Early payment incentives

- Electronic payment enablement

- Inventory improvements

- Buying cooperatives amongst similar clients

- Cheaper supplier alternatives

- High-interest savings accounts

- Pricing and discounting strategies

Customer portfolio and supply chain analysis

The current volatility of supply and demand is putting pressure on businesses throughout the supply chain. This means that, at any given moment, your clients’ suppliers or customers could find themselves in jeopardy, posing a risk to your clients’ bottom line. With complete and reliable data about the sources of your clients’ revenue generation and outgoings, you can analyse their supply chain to pinpoint over-reliance on any particular companies. In Dext Precision, it’s a simple case of running the Customer Reliance and/or Supplier Reliance reports to check your clients have a ‘healthy’ split and are not overly dependent on particular businesses.

Scheduling and chasing payments

Helping your clients schedule payments to make the most of 30-day credit terms is an easy way to get better control of cash flow. There are also a range of payment apps and debt recovery workflow tools you could recommend to help get them paid on time. With reliable cash flow data from these solutions, you can then advise your client on when to make big purchases, to ensure it’s the most tax efficient time to buy whilst protecting their cash reserves.

Maximising tax savings

Building on advice for big purchases and tax efficiencies, depending on the size, turnover, region, and industry your client operates in, they may be eligible for a range of tax relief schemes and other government support. With reliable and complete client data available to your practice, you could help by advising which schemes and funds your clients are eligible for and how/when to apply to ensure they are making the most of the financial aid available whilst paying the least amount of taxes required by law.

Benchmarking against comparable businesses

In challenging times, business benchmarking can provide clients with the confidence that they are set up for success. It can also highlight opportunities to reduce cost bases, improve operations, or indeed make investments to recuperate and/or develop a competitive advantage. This level of analysis requires high data quality, and is very difficult to achieve manually. However, using the Benchmarking insight feature in Dext Precision, you can benchmark both Turnover and Expenses for your clients within their region, industry, or all other clients, either against your own practice or across a wider Precision data set.

Sensitivity analysis

If your client has invested in your recommended systems to support high-quality, real-time data, then it’s likely you have the necessary information to provide sensitivity analysis or ‘what if’ analysis to assist with scenario planning for a range of eventualities. For example, predicting what would happen if turnover dropped by 20%. Modelling client data this way means you can help paint the picture of how resilient their business model/mechanisms are to economic uncertainties, and input to their risk management strategies.

Financing and investment applications

By investing in data reliability and automating the tracking of leading indicators to identify clients that may need extra attention and services, Dext Precision can also help you identify clients that would benefit from your support with finance or investment applications. Understanding your clients’ business goals as well as their financial performance puts you in a good position to liaise with banks, lenders and business finance specialists to get the advice and funding that’s needed to put their recovery - or indeed their expansion - plans into action.

Ready to improve data quality management for your clients, and your firm?

For more information about establishing good data quality practices for your firm, and your clients, download our latest guide:

Navigating economic turbulence with quality client data: expert tips and insights