Stop chasing receipts and invoices, with Dext, they come to you

How much time does your team waste tracking down the bookkeeping records they need to do their jobs? Too much. With Dext, you can save up to 5.5 hours per client, per month on manual data entry.

2023 Winner - ‘ Best Accounting Cloud-Based Software Company’

2024 UK Winner - Xero small business app of the year

2024 US Winner - Xero small business app of the year

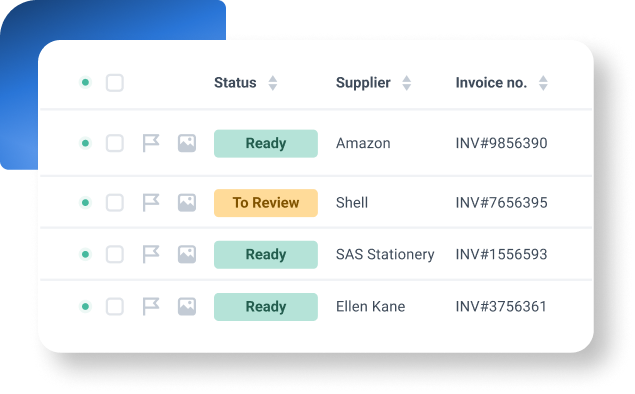

Multiple ways to collect client expense and invoice records

- Upload

- Invoice fetch

- Bank feeds

- Bank statements

Upload

If you like to keep things simple, you can upload items directly from your computer. Select a file or drag & drop. We’ll let you know when the item has been uploaded.

See how

Dext

captures

client records

in record time

Discover how capturing receipts and invoices across mobile, email, web, and integrations sets the stage for seamless bookkeeping. Watch the product tour.

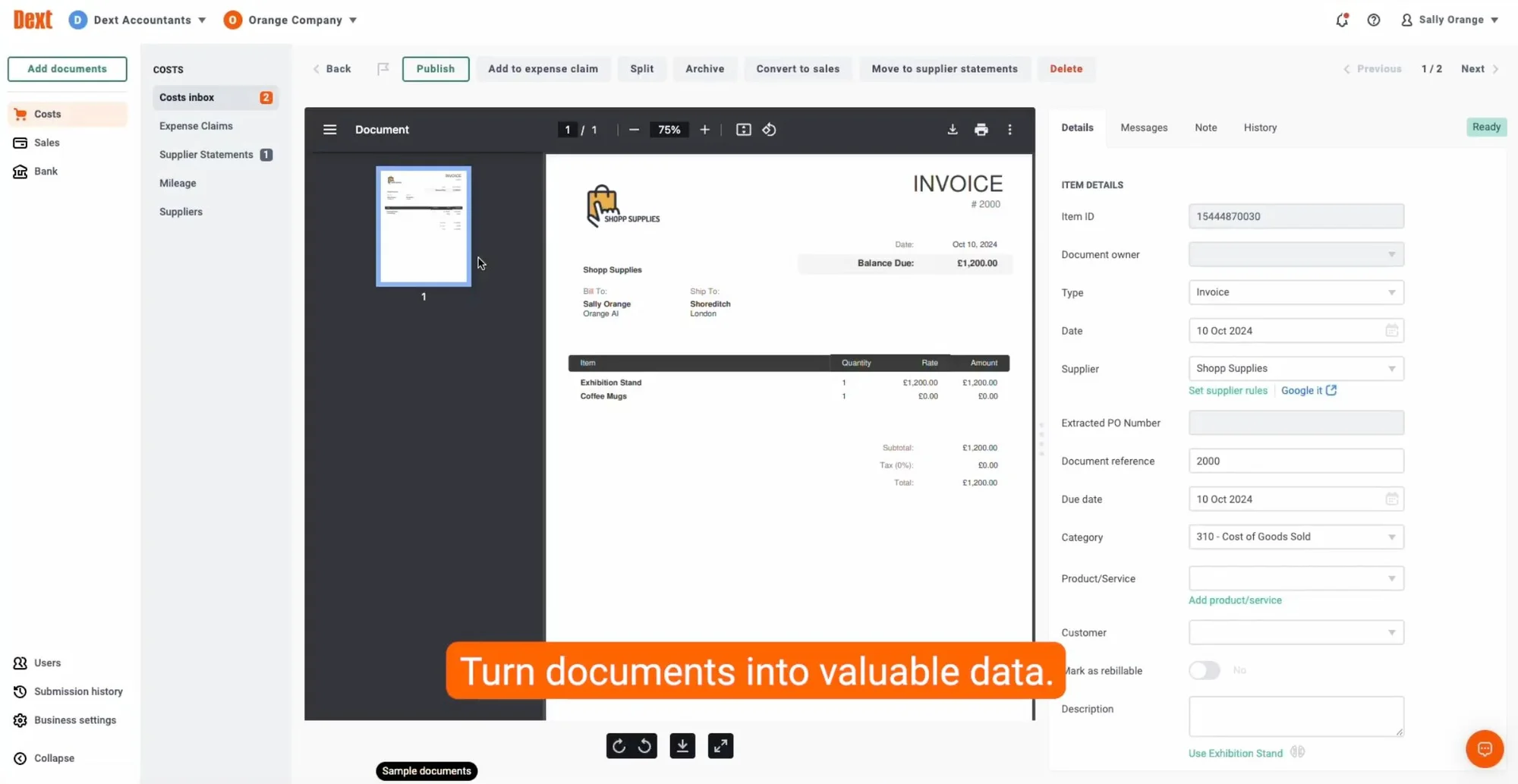

The bookkeeping info you need, right where you need it

With Dext, you can say a not-so-fond farewell to tedious record and information collection. No more tracking down client receipts, invoices and statements. Everything you need is quickly, accurately and automatically collected for you. No manual entry required.

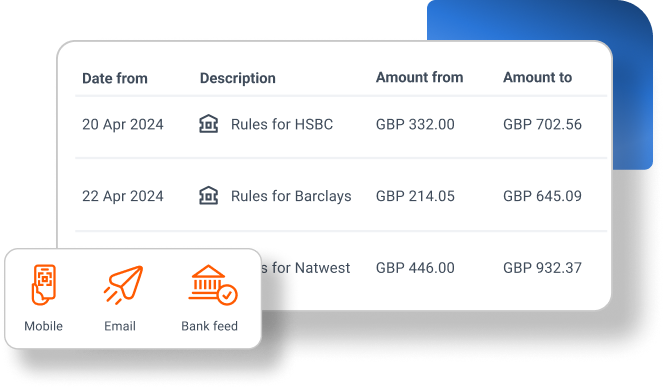

Mobile, email, bank feeds, whatever

We make it easy for clients to give you all the information you need. They can scan receipts and invoices when they get them. Invoices can also be emailed to a dedicated address. Bank feeds can be automatically connected and synced. Everything is captured, turned into readable data and published directly to your accounting software. Putting time back into your hands.

Dext works with the systems that

work for you

Dext helps you get data from the digital platforms that today’s businesses rely on. We work with major e-commerce providers such as Shopify, Amazon, Etsy and WooCommerce together with payment providers such as Square and Stripe. In fact, we integrate with over 11,500 banks and institutions worldwide to capture information directly from the source of your clients’ transactions. So you don’t have to.

Plans to suit your business

All pricing plans cover the accounting essentials, with room to grow.

Join thousands of firms who rely on Dext for bookkeeping data capture

Businesses globally

Accounting and bookkeeping firms

Business documents processed annually

CUSTOMER TESTIMONIAL

“I’m not going to waste my time doing manual data entry when I can use a tool like Dext. We grew from 45 clients to 178, with room to take on even more. We can do this and make a reasonable profit because we're using technology.

Denise Twigger — Founder, Bas & Balances

“Dext is very reliable. Having been pushed to go digital with tax returns we found Dext easy to replace the manual system we operated. ”

D J Gallagher, UK

“Dext enables us and our clients to automate the paperwork we submit using supplier rules and direct integration with Xero. ”

Becky Jama

“I use to spend hours adding up, scanning and attaching slips. Now I scan and it automatically goes to Xero and recons. Best thing to save loads of time!”

Sonja Vermeulen

“The Dext product help us be at the forefront of our future. It’s all about partnerships and mutually beneficial growth”

Rachel S

“Dext is Best! It's so easy to use and does a lot of the work for you which frees you up to concentrate on other tasks. ”

Debbie Johnson

“Dext facilitates document submission in real time, avoiding delays and extra work for later. Easy to use. Our experience has been very positive since we started using it.”

Yolly Gomez

“Dext is very reliable. Having been pushed to go digital with tax returns we found Dext easy to replace the manual system we operated. ”

D J Gallagher, UK

“Dext enables us and our clients to automate the paperwork we submit using supplier rules and direct integration with Xero. ”

Becky Jama

“I use to spend hours adding up, scanning and attaching slips. Now I scan and it automatically goes to Xero and recons. Best thing to save loads of time!”

Sonja Vermeulen

“The Dext product help us be at the forefront of our future. It’s all about partnerships and mutually beneficial growth”

Rachel S

“Dext is Best! It's so easy to use and does a lot of the work for you which frees you up to concentrate on other tasks. ”

Debbie Johnson

“Dext facilitates document submission in real time, avoiding delays and extra work for later. Easy to use. Our experience has been very positive since we started using it.”

Yolly Gomez

“Dext is very reliable. Having been pushed to go digital with tax returns we found Dext easy to replace the manual system we operated. ”

D J Gallagher, UK

“Dext enables us and our clients to automate the paperwork we submit using supplier rules and direct integration with Xero. ”

Becky Jama

“I use to spend hours adding up, scanning and attaching slips. Now I scan and it automatically goes to Xero and recons. Best thing to save loads of time!”

Sonja Vermeulen

“The Dext product help us be at the forefront of our future. It’s all about partnerships and mutually beneficial growth”

Rachel S

“Dext is Best! It's so easy to use and does a lot of the work for you which frees you up to concentrate on other tasks. ”

Debbie Johnson

“Dext facilitates document submission in real time, avoiding delays and extra work for later. Easy to use. Our experience has been very positive since we started using it.”

Yolly Gomez

Our support service is at your disposal

Our support service answers your technical questions by chat or email and offers you valuable advice to support your digital transition.

customer satisfaction rating (NPS)

48 hours

median time to first response.

+ 250 tutorials

available on our Help Centre

Try Dext yourself with our 14-day free trial

Over 700,000 businesses and 12,000 bookkeeping and accounting firms worldwide use Dext to make more time for the things they do best. Click below to find out more.

Bookkeeping data capture FAQs

Simply use our bookkeeping app to scan and capture your data or submit your document in the Dext platform via email or upload. Then let our technology automatically extract and categorise data.

Dext invoice capture software uses advanced AI and OCR technologies to quickly extract the data you need. Our proven accuracy allows you to trust our system and save time.

We leverage AI technology in our invoice and receipt capture software to accurately collect bookkeeping data from your documents. Our software also offers of bookkeeping automation features to help you time.

Well, we don't want to show off but we are pretty much the best at accuracy.

Dext's receipt and invoice capture software is best in class with 99.9% accuracy when extracting data from invoices and receipts. We can even read handwritten or crumpled receipts!

The easiest way to get started with Dext and discover the potential of our invoice capture software is to start a free trial. No string attached. If you see benefits chose your plan, if not you can stop. We are confident you will stay and save time with Dext's bookkeeping solutions.

Dext delivers 99%+ OCR accuracy, extracting complete invoice fields including date, amount, supplier, tax, currency, and invoice number.

Yes—your documents are encrypted, stored for 7–10 years in your financial document storage Vault, and always audit-ready.