Why MTD ITSA Software is a Worthwhile Investment

MTD for ITSA signals a significant change for accountants and bookkeepers and how they manage their landlord and sole trader clients. The legislation is the latest step in a long line of initiatives driving digital transformation. It’s now up to firms to find MTD ITSA software that allows them to do that.

After it was announced that MTD ITSA will be delayed until 2026, some might see talk of software as a conversation for a later date. Others may not even see it as necessary. Whatever your stance, at Dext, we believe this specialist type of software is imperative if firms want a smooth transition.

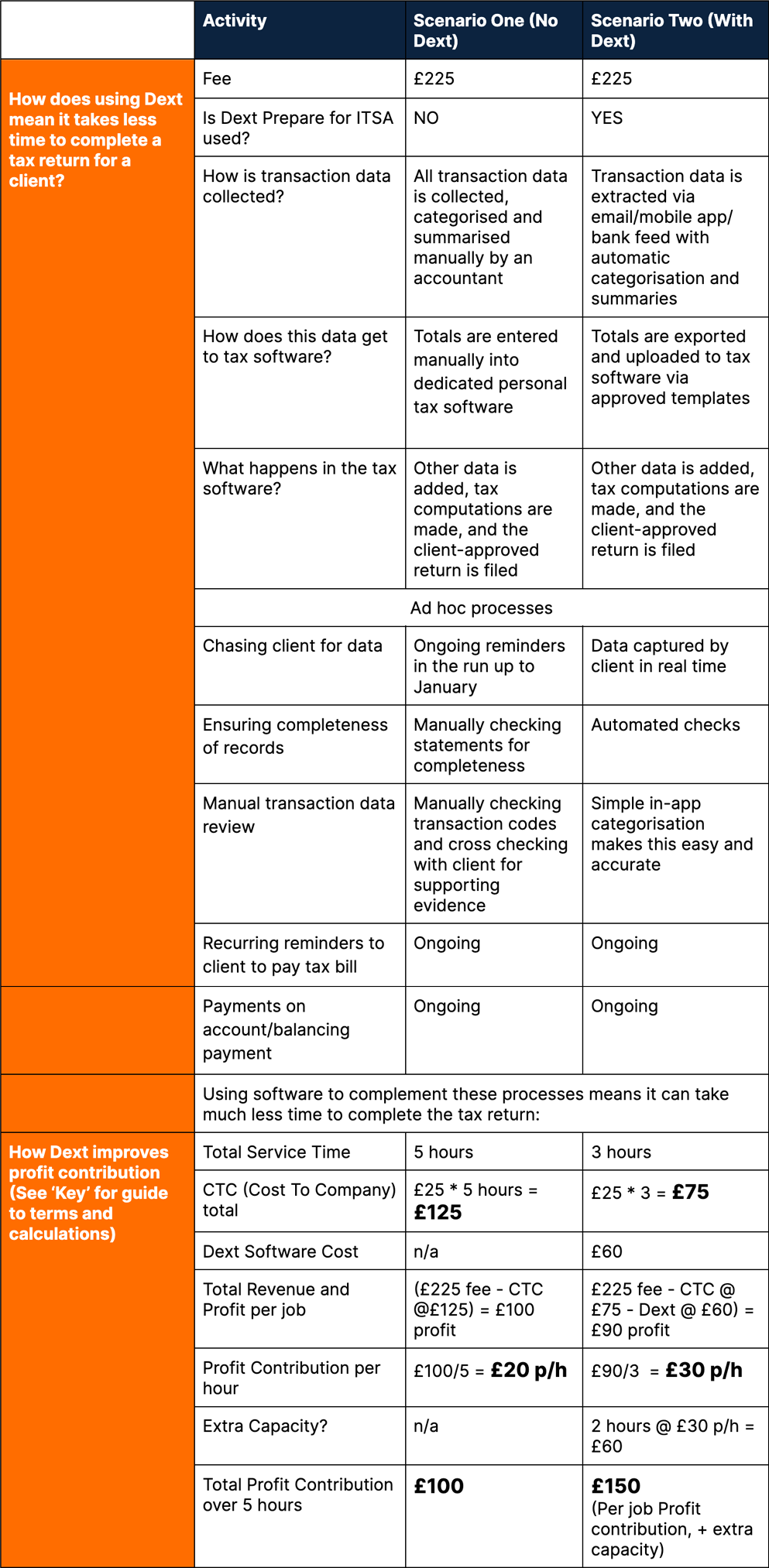

In this blog, we’ll be explaining why MTD ITSA software is a worthwhile investment to continue your move to digitalisation, reducing the time it takes to service an ITSA client from 5 to 3 hours.

We've modelled a scenario which shows that this could boost your profitability by as much as £50 per ITSA client, but before we get into that, let’s define exactly what MTD ITSA software is.

What is MTD ITSA software?

MTD ITSA software refers to digital tools and systems that are designed to help individuals and businesses comply with the Making Tax Digital (MTD) requirements for Income Tax Self Assessment (ITSA) in the UK.

This type of software can be used to record and categorise income and expenses, generate reports, and file tax returns with HMRC. The common theme is efficiency, with most providers looking to help accountants, bookkeepers and their clients streamline the entire process, from data collection through to HMRC submission.

Why is MTD ITSA software a good investment?

Before we dive into a number of potential scenarios, we thought it’d be helpful to outline the basic reasons as to why your firm should invest in MTD ITSA software now. These are just a handful of the core benefits, which can be applied to nearly all accounting firms.

1. Organisation

Above all, digital record keeping means records are easily organised and stored in a centralised place. That means your team has one single source of truth when it comes to locating and retrieving client data. It also ensures easy access in real time, which aids proceedings if at any point HMRC inquires into a return.

2. Efficiency

As mentioned, efficiency is at the heart of most MTD ITSA software. This is most apparent in the way software eliminates the need for manual bookkeeping and reduces the time and effort required to prepare and submit tax returns. Not only does it improve the efficiency of tax compliance, but it also reduces the likelihood of human errors significantly.

3. Analysis

Spreadsheets serve a purpose, but it’s often so much easier to analyse performance when you’re working from specialist software. There’s often a whole load of additional work that’s required when you work from a spreadsheet. Software, on the other hand, is configured for analysis, with easy-to-understand formatting and accessible metrics.

4. Sustainability

In today’s world, businesses must strive to do their bit to help promote best sustainable practices. Of course, there are certain industries where this responsibility bears more weight. But accounting, too, must find ways to change. MTD ITSA software – and digital record keeping, in general – is a great way to reduce the amount of paper we use, as there’s no need to print out supporting paperwork when an invoice has been emailed across.

5. Compliance with MTD ITSA requirements

Of course, software solutions should, first and foremost, help solve problems. In this instance, HMRC proposes to make it mandatory for self-employed individuals and landlords with annual turnover exceeding £50,000 to maintain digital records and submit tax returns digitally. And failure to comply with those guidelines may result in penalties and interest.

How does MTD for ITSA software boost profitability?

Now you’re familiar with the fundamental benefits of MTD ITSA software, it’s time to put it all into context. Let’s show you how we've modelled a scenario where our solution, Dext Prepare for ITSA, could boost your profitability by as much as £50 per ITSA client.

Scroll down to find out how you could generate an extra £50 per ITSA client.

For accounting and bookkeeping firms, we know that time is money. And that’s the same whether you’re billing clients on value, time or fixed fees. With that in mind, Dext Prepare for ITSA was designed to reduce the time it would normally take to service an ITSA client. It does this by:

- Removing the need for manual data entry

- Reducing the risk of human error with accurate automated extraction

- Using automation to help ensure completeness of records

- Giving you access to the data you need, for whatever date range you need, and the ability to export to formats that suit your existing workflows

We’ve provided a step-by-step, scenario-based breakdown of what servicing an ITSA client looks like with and without software. When you take all of those things into consideration, firms could reduce the time it takes to service an ITSA client by as much as 50%*. And, what’s more, you can use that extra capacity to focus on additional billable services.

By using Dext Prepare for ITSA you can reduce the time it takes to service an ITSA client from 5 to 3 hours. With an estimated Cost to Company (CTC) of £25 per hour, that means the total is just £75 when using software, compared to £125 when working without it. The incurred software cost (£60 in the case of Dext Prepare for ITSA) means the total profit stands at £90 per job, compared to £100 per job when not using software; this is based on the assumption that firms charge £225 for the tax return service.

- When looking at the ‘profit contribution per job’ divided by hours it takes to complete the job, we can see that profit per hour increases from £20 to £30 (even taking into account the software cost)

- And when using software, the firm has an extra two hours of capacity, which can also generate an hourly profit contribution rate of £30

- And with the two hours additional capacity, you can apply the same hourly rate for other billable services.

The bottom line is that, over five hours – the average time it takes to complete a tax return – you can walk away with £150 profit contribution when using Dext Prepare for ITSA, (even taking into account the software cost) compared to £100 when doing this work manually.

Now, apply this rationale to 100 similar clients, and your firm unlocks an extra 200 hours, which when fully utilised equates to a value of £5,000.

As always, Dext gives you time, and time is everything in accounting.

Feel free to work your way through the table and see where MTD ITSA software saves you valuable time. In this instance we’ll be using Dext Prepare for ITSA as the software example, and we've set the fee at £225.

*Note: All estimates are based off internal Dext research

Image 1: Scenarios demonstrating the benefits of using MTD ITSA software when servicing clients

Image 1: Scenarios demonstrating the benefits of using MTD ITSA software when servicing clients

Key

1. The client is a self-employed, non-vat-registered individual, or a client who has income derived from property

2. CTC is ‘cost-to-company’, This is the not the charge-out rate for the individual at the firm, rather the cost to the firm of employing that individual

3. This calculation only focuses on employee time cost and ITSA specific software, and not other cost factors

Next steps

We hope this blog has given you a much clearer understanding of MTD ITSA software as a whole. There are a number of benefits as to why firms should invest in a solution. And we hope that the example we’ve provided demonstrates how you can make that investment worthwhile.

In terms of finding your MTD ITSA software solution, we’d love to help. If you’re an existing Dext Prepare customer, yet to add our ITSA solution to your plan, click below to book a free ITSA consultation with one of our team. If you’re not an existing Dext Prepare customer, click here to find out more about our solution and how it can help you.