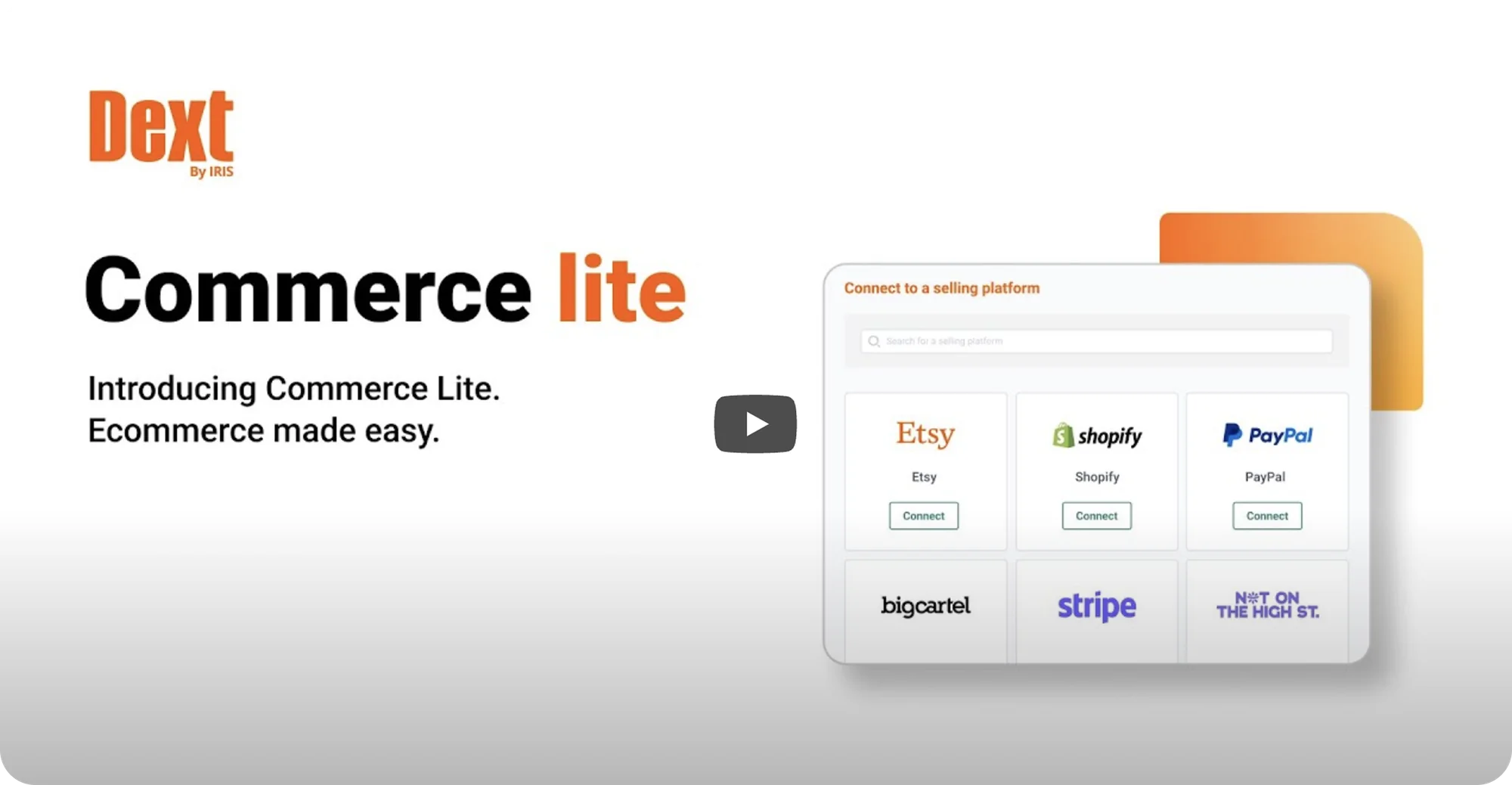

E-commerce Made Easy

More and more businesses are selling online. But managing the bookkeeping for smaller ecommerce clients can still be complex. That’s where Commerce Lite can help.

2023 Winner - ‘ Best Accounting Cloud-Based Software Company’

2024 UK Winner - Xero small business app of the year

2024 US Winner - Xero small business app of the year

Connected bookkeeping

for a connected age

Everything in one place:

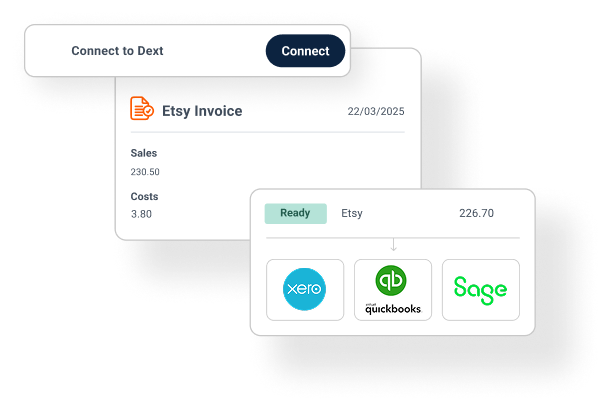

Commerce Lite is ideal for smaller e-commerce businesses selling on up to 5 platforms., Iit captures sales transactions from e-commerce stores and online marketplaces automatically, and brings them together in one consolidated view.

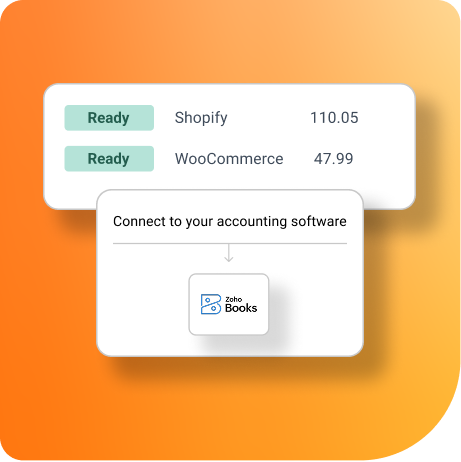

Connect where your clients do business

From Shopify, Etsy and eBay to Stripe, Paypal, WooCommerce and more, we make getting the data you need simple and painless. It means you can serve your clients no matter how and where they choose to sell.

Effortlessly access the sales data you need:

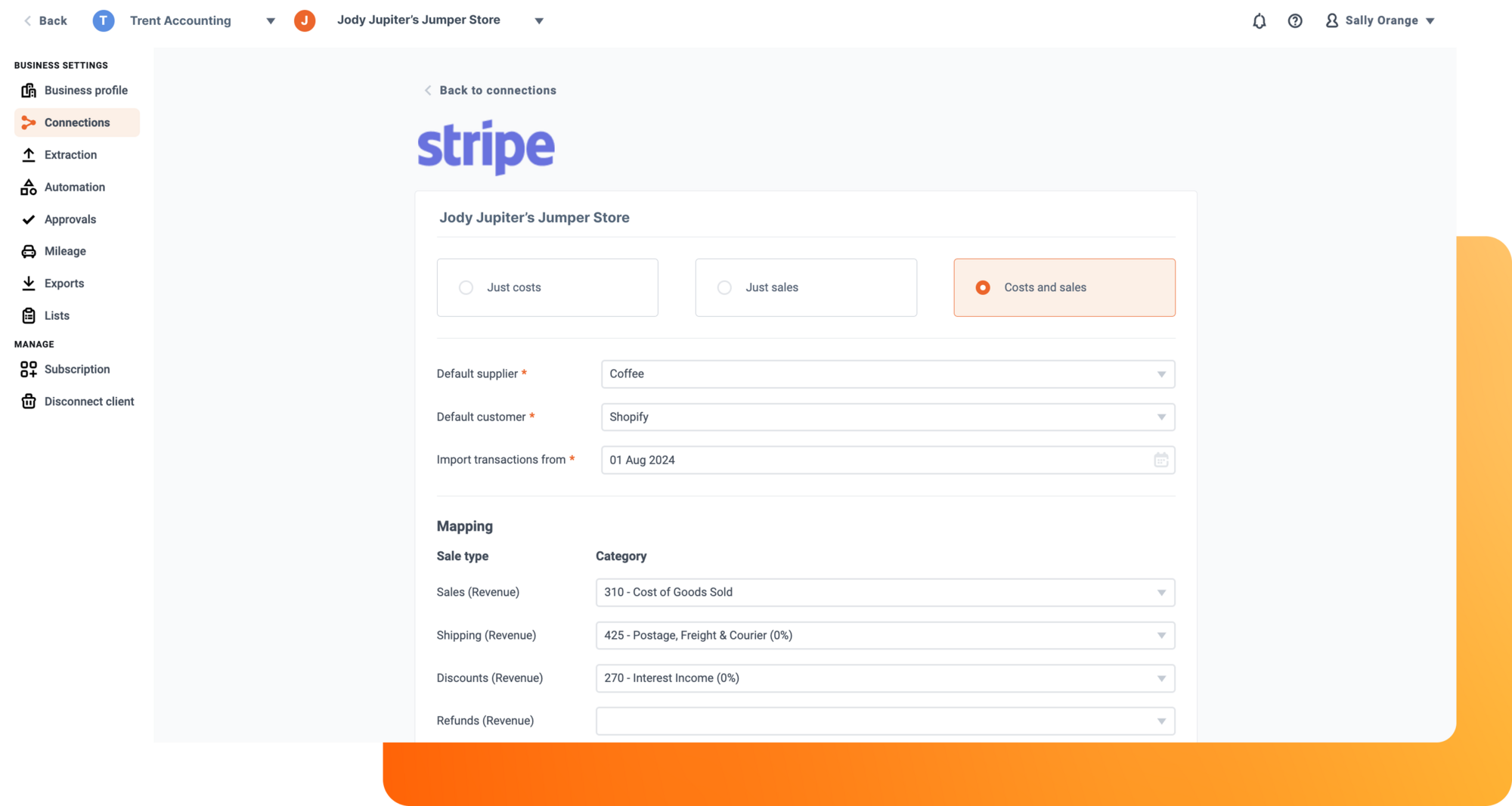

Easily access essential sales, fees, refund, and reimbursement transactions and send it straight to your accounting software, ideal for fast reconciliation and reporting.

Work within Dext

Commerce Lite is fully integrated into Dext,so you can manage everything in one place with no need for an additional app

Everything small e-commerce clients need – nothing they don’t:

Commerce Lite focuses on the core features smaller e-commerce clients need, without the overhead of advanced functionality that may not be necessary for their business.

Who is Commerce Lite For?

Commerce Lite is designed for small businesses who want a simple, efficient way to manage their online sales data. It’s perfect for businesses that:

- Sell on up to 5 ecommerce platforms

- Need fast, reliable access to a summary of sales and cost data—without the hassle of manual data entry

- Are looking for an affordable, scalable solution to manage their online sales data, all within the Dext ecosystem, without the need for additional apps or software

For online businesses with more advanced needs, such as using more than 5 ecommerce platforms or marketplaces or requiring in-depth, SKU-level analysis our Commerce Pro feature available later this year will be better suited.

See it in action

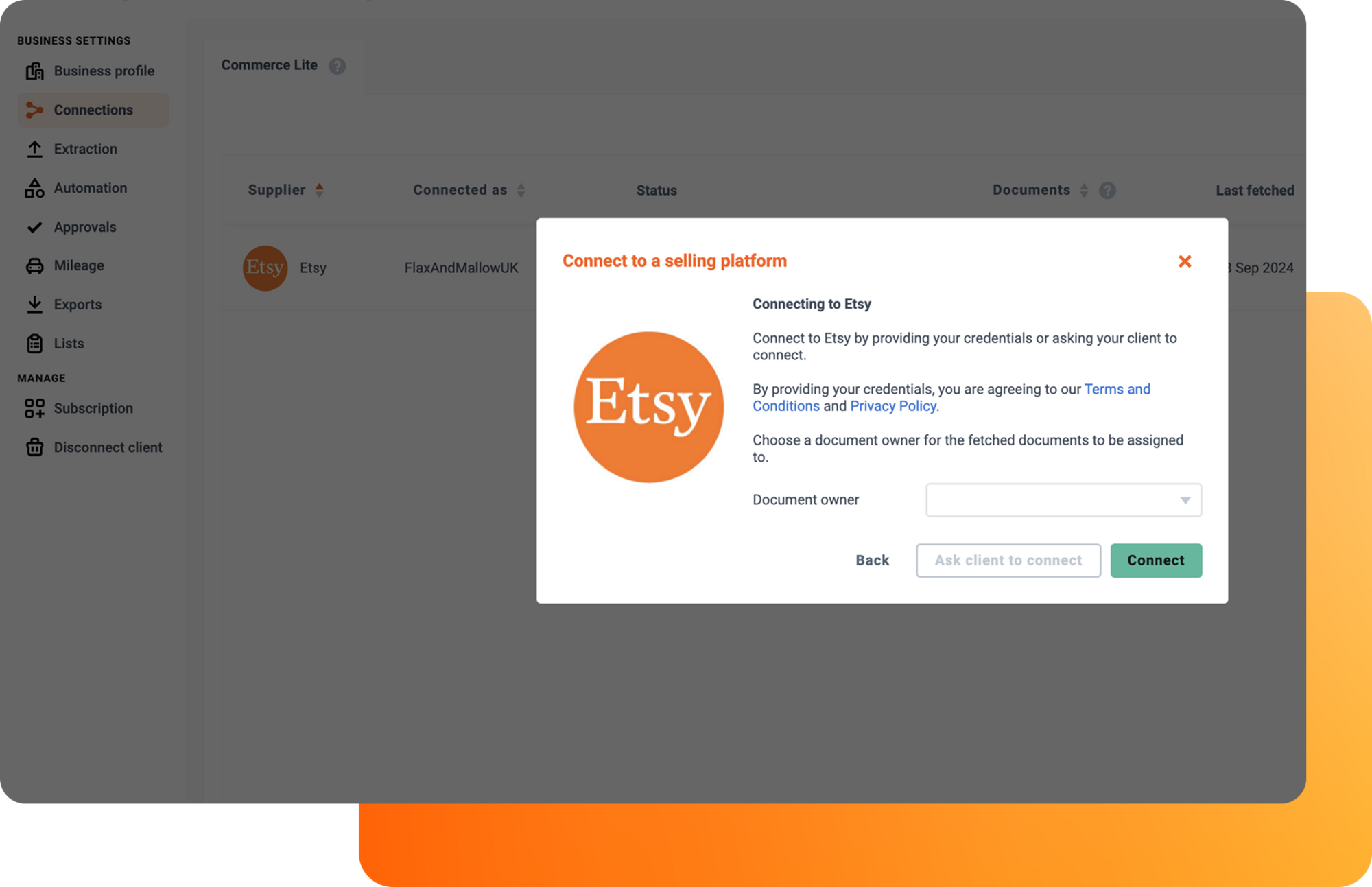

Connect where your clients are

Dext connects to the platforms where your clients do business. We collect transactions from ecommerce sites and marketplaces. So you don’t have to.

Not using Dext yet?

Commerce Lite is only available with a Dext subscription.

Try Dext for free for 14 days

Existing Dext Customers

Try Commerce Lite free for 30 days! Log in to Dext and go to Connections and then start your free trial