- ProductExplore our bookkeeping automation features

- SectorsBusiness benefits and key sectors

- Pricing

- ResourcesAccess support, learn and grow

How Cash Flow Planning Can Help Future-Proof Your Business

In part 1, we looked at cash flow management and how to introduce it into your business. Here, we’ll be looking at cash flow planning and how it can set you up for success both today and later down the line.

Once you understand your business’s current cash flow, it’s time to estimate where it’s heading. This is the best way to future-proof your business and preserve your cash flow in the long run. A recent survey shows 31% of SMBs only have two months of cash reserves available to sustain activity. If that sounds familiar and you want to increase your cash reserve, the answer lies in cash flow planning.

In this blog, we’ll be piecing together the ins and outs of cash flow planning. We’ll also be looking at cash flow forecasts and sharing a process to help put you in the best position to plan well. Before that, let’s start with the basics.

What is a business cash flow forecast?

Why is it important to have a cash flow plan?

Long-term vs short-term cash flow planning

Preparing for your cash flow plan

How to do a cash flow forecast

What is a cash flow plan?

Cash flow plans are financial tools that help businesses track and organise potential income. It's close as business owners can get to seeing into the future. With solid cash flow planning, you can estimate the money set to move in and out of your business over a period of time. You can usually plan twelve months in advance but you can also calculate it on a short-term basis. A good plan also shows you an accurate projection of your expenses and income over that period.

What is a business cash flow forecast?

Cash flow planning and cash flow forecasting are often used interchangeably. This isn’t a major issue – but it is important to outline the nuances and how the two fit together. To put it simply, cash flow forecasting sits under the broader category of cash flow planning. Forecasts provide the framework in which planning can take place. And a projection of what your cash flow will look like in twelve months time or less. Once you have that, you can then plan your cash flow and business activity accordingly.

Cash flow planning also enables good cash flow management. Let's say in twelve months time the forecast projects you to be spending more than you earn. With that foresight, you can pivot your business’s financial activity to help reverse that potential outcome. Are there certain expenses you can reduce or cut to help reduce your outgoings? Cash Flow forecasts set the roadmap, whereas cash flow management allows you to hit those milestones.

Why is it important to have a cash flow plan?

As mentioned, your cash flow plan is the best way for you to see what’s to come. If good cash flow management secures the foundations for a healthy business, cash flow planning ensures it stays that way. Without this kind of foresight, you risk encountering cash flow problems. That might mean inaccurate budgeting, overspending and missing out on investment opportunities. Instead, proactive planning increases your business's chances of being profitable and improves longevity.

Now you know what cash flow planning is and why it’s so important, it’s time to look at the options you have when preparing yours.

Long-term vs short-term cash flow planning

The first thing to do is decide what timeframe you'll be working towards. Will it be short-term or long-term cash flow planning? And what processes can you put in place to ensure your cash flow runs smoothly? Before that, let’s look at the difference between long and short term cash flow strategies.

What is short-term cash flow planning?

Short-term cash flow planning looks at the cash inflows and outflows for under twelve months, which then helps you forecast. Standard projection intervals include thirty days, sixty days, or ninety days. Financial professionals can then use those to assess short term investment opportunities.

If you’re looking at short-term cash flow, you need to record any outstanding invoices in either the purchase ledger or sales ledger. When those invoices aren't recorded within the correct period, your forecast could miss significant amounts due, resulting in an incorrect cash flow projection. You also need to reconcile all bank accounts. If not, you risk making poor decisions and late payments to suppliers or employees.

What is long-term cash flow planning?

You prepare long-term forecasts by looking at activity from the previous period and use that as a blueprint for the next twelve months. With an accurate starting position, you can flex the numbers to see the impact of an increase or decrease in income or expenditure. To ensure forecast accuracy, you need to record all received and sent invoices in your accounting software.

Long-term forecasts are better for strategic decision making. They're often required when meeting with your bank (alongside a balance sheet and profit and loss account). Long-term forecasts also help identify whether you need to increase the overdraft facility or restructure any existing debts.

With long-term forecasts, you may have been subject to one-off costs in the previous year that won’t be incurred in the future. So what’s the solution? This is where having a readily accessible, digital copy of the invoice is so helpful. Otherwise, you end up trawling through boxes of invoices to find out exactly what the transaction is related to.

When it comes to cash flow planning, accuracy rules. Both short and long-term planning rely on the numbers you’re working with being up to date and error-free. It's as simple as this: when your records are accurate, so is your cash flow planning.

Preparing for your cash flow plan

So much of cash flow hinges on having readily available data. Whether you’re creating forecasts, managing expenses or sorting out potential cash flow problems, a clear and accurate view of your records puts you in a much better position to do those jobs well.

So, before you start your plan, it’s important to establish a process that gives you that real-time control. We’ve put together a straightforward three-step flow that should help you do just that.

Step 1: Accurate recording

It can be challenging to track all your expenses, the money you owe suppliers and the income your business makes. The key is to speed up how you get that data into your accounting software, ready for cash flow management and forecasting.

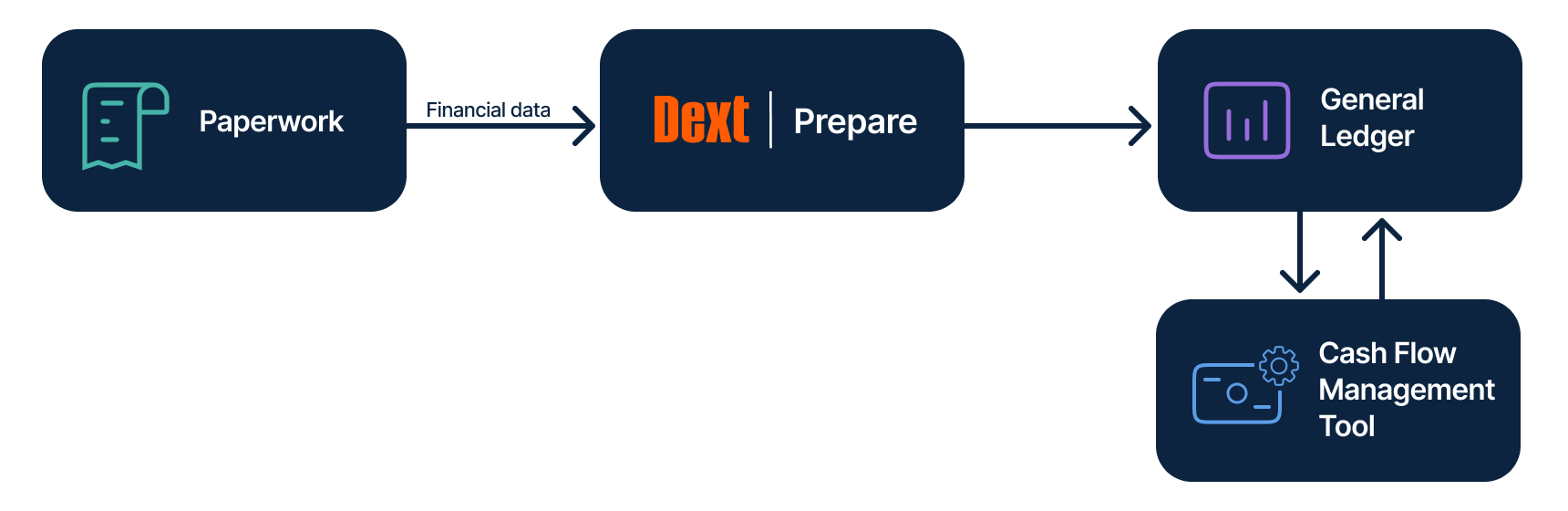

What's the best way to do this? Technology like Dext Prepare automates this process with its accurate receipt scanning software. With many ways to upload, the tool gives you a clear picture of your business spending, which you can then connect to your general ledger. You’ll have an up-to-date view of your business’ financial activity which, by the way, you can upload on the go at the click of a few buttons.

Step 2: Send to your accounting software

Your general ledger – otherwise known as your accounting software – is the central hub for your cash flow strategy. Once you’ve gathered that information using software like Dext, it’s then aggregated in your accounting system. From here, you can create reports, track cash flow and align account balances with your accounting periods.

Step 3: Connect with a cash flow management tool

While many general ledgers offer cash flow solutions, it’s worth exploring specific cash flow software. You can build forecasts and compare them to previous transactions. And focus on your cash flow view without the distraction of other areas of business finance. By connecting it with your accounting software, you create an efficient and integrated financial management system that aligns planning, management and forecasting.

How to do a cash flow forecast

Cash flow forecasts are the foundation for successful cash flow planning. When it comes to preparing your cash flow forecast, much of the work can be done within your general ledger or cash flow management tool. If you don’t have one of those, though, then you can break the process down into four key steps.

1. Pick your planning time frame

You can plan cash flow twelve months in advance or a few weeks ahead. Whether you choose to plan on a short-term or long-term basis is up to you and what suits your business. The key is to plan ahead for as far as you can while remaining as accurate as possible. If your business is established, you’ll have the data you need to make those far-into-the-future projections. If you’re a new business you may have to opt for a shorter time frame.

2. List the money coming into your business

Whether it's on a weekly or monthly basis, make a note of all the cash that’s coming into your business. Create a column for the week or month, then a second column that explains what type of income it is. For example, is it sales, tax refunds, grants or investments?

Be careful to only list payments that you know will land. If not, you may see a large gap between your projected forecast and the actual amount of money in your account. Once you’ve completed your list, add up the totals within each weekly or monthly column. This is your net income.

3. List the money going out of your business

We’ve now got to do the same exercise for the money that leaves the business. That may include money you spend on rent, marketing, bills, salaries, expenses or materials. Again, add these up for each column and you’re left with your net outgoings.

4. Work out your running cash flow

Subtract your net outgoings from your net income for each weekly or monthly column. The result will show whether you’ll have positive cash flow (there’s more money coming in than there is being spent). Or a negative cash flow figure (you’re spending more than you’ve got coming in). This projection is your cash flow forecast.

If you’re operating in the red month after month, then it’s clear you’ve got cash flow forecast problems. If this is the case, you should look at what you need to do to stop that from happening like reducing your outgoings. But there’s no need to panic. In fact, only 52% of UK SMEs said they were cash flow positive. If you’re one of those, it may a good time to reinvest and ramp up activity.

Wrapping up

So there you have it, cash flow planning in a nutshell. While there’s often a lot of work to do when planning your cash flow, the foresight it gives you is unrivalled. It’s a clear snapshot of your cash flow’s future performance. And the most accurate reflection of where your business, as a whole, will be.

Of course, that snapshot is all dependent on the data you use being accurate and up-to-date. When it’s not, you risk undermining the entire forecast. With smart data extraction from software like Dext Prepare, you can upload all the information you need from receipts, bills, invoices and more, directly to your accounting software – accurate data which you can then proactively plan from.

If you’d like to find out more about business cash flow as a whole, click below to download our Beginner's Guide to Smart Cash Flow. You can also explore Dext Prepare's award-winning extraction, automation tools and thousands of integrations with other business finance providers.