MTD IT made simple: how Solo automates the hard work for firms and clients

Key Takeaways

Built for MTD for IT: HMRC-recognised software designed to help sole traders and landlords stay compliant with quarterly digital reporting.

Automates the heavy lifting: Capture, categorise, manage disallowables, match bank transactions, and submit directly to HMRC. All in one place.

One clear digital workspace: Trading and property income combined for a complete, review-ready audit trail.

Scalable for growing firms: Smart rules, duplicate detection, and automation create consistent, repeatable MTD workflows.

Fits around your existing process: Submit quarterly in Solo while keeping your trusted year-end finalisation tools and pricing structure.

Summary

Making Tax Digital for Income Tax (MTD for IT) introduces quarterly reporting, stricter digital record-keeping, and new habits for sole traders, landlords, and the firms that support them. Our MTD software Dext Solo is purpose-built to remove the friction from this transition. It automates document capture, categorisation, disallowables, banking, reporting, and quarterly submissions—while fitting neatly around existing year-end workflows. The result is accurate digital records, confident HMRC submissions, and a scalable, repeatable process for firms managing growing MTD client bases.

The practical path to digital compliance

Making Tax Digital for Income Tax (MTD for IT) is reshaping how sole traders and private landlords maintain records and report to HMRC. For firms, the first couple of years typically bring new habits, more client education, and a new quarterly cadence. The goal is clear: accurate digital records, timely submissions, and minimal disruption. Dext Solo is built to take on the heavy lifting like streamlining capture, automating categorisation and disallowables, and enabling confident quarterly updates.

Explore Dext Solo and visit our MTD for IT guide for timelines, checklists, and best practice.

Who Dext Solo is for

Dext Solo is designed for self-employed individuals and private landlords who are not incorporated, not VAT-registered, and not using integrated accounting software. It supports both trading income (SA103F) and property income (SA105), making it ideal for clients with mixed income sources. By consolidating sources and documents in a single workspace, Solo helps practitioners keep a clear digital audit trail ready for analytical review and HMRC scrutiny.

Learn more about Solo for accountants and bookkeepers.

Recognised and ready for MTD for IT

Dext Solo is officially recognised by HMRC as an MTD for IT solution and participates in the HMRC beta programme. Quarterly updates can be submitted directly from Solo, so you can establish your new process now and avoid end-of-period rushes.

Read more: MTD for IT with Solo • Quarterly updates overview.

Flexible capture: meet clients where they are

Clients work in different ways. Solo offers multiple, practical routes to get data in so nothing gets missed:

Drag and drop: Upload files from desktop in seconds.

Email-in: Forward bills and receipts to a unique address; suppliers can be CC’d for hands-free capture.

Mobile app (Snap): Clients photograph receipts on the go, on site, in the van or at the café and data lands in your workspace in real time.

WhatsApp submission: Activate WhatsApp for clients who already message images; uploads arrive with a full audit trail and appear in the correct workspace.

Bank feeds: Connect accounts for an ongoing flow of transactions.

Bank statement extraction: Upload PDF statements and auto-extract to populate transactions quickly.

Deep dives: Document capture • WhatsApp capture • Bank statement extraction

One workspace, all income sources

Solo brings income sources into a single view, reducing confusion and speeding up categorisation. Whether it’s trading or property income, documents and transactions sit together so there’s one login and a consistent experience across costs, sales, and bank. That means less to explain to clients and less time spent hunting for items across different areas.

Automation that saves hours

MTD compliance shouldn’t increase manual load. Solo focuses on automations that cut repetition and reduce risk:

Smart categorisation & supplier rules: Set rules for recurring suppliers and patterns so new items are automatically treated correctly.

Disallowable expenditure handled: Configure categories mapped to the correct return boxes and automate common disallowables (for example, mixed-use motoring). This reduces quarter-end adjustments and rework.

Duplicate detection: Catch duplicates (e.g. card receipt and scanned receipt for the same purchase) before they hit your totals.

Mileage: Mileage tracking via web or mobile with GPS tracking for fast, accurate claims.

Create documents for adjustments: Add quarter-specific adjustments that aren’t in the bank, with clean categorisation and auditability.

Advanced search: Search the full receipt text (not only extracted fields) to resolve HMRC or client queries rapidly.

New: Sales invoice creation

For many self-employed clients, invoicing still lives in Word or ad-hoc templates. Solo now includes sales invoice creation so clients can raise and send professional invoices from the same system used to capture costs and manage bank activity. Store customer details, add products/services, and send directly. Keeping documentation and income records aligned from day one.

Smarter banking: matching, rules and requests

The bank workspace is where transaction flow turns into tidy books:

Document matching: Quickly match bank transactions to supporting paperwork from costs or sales. When a receipt arrives later (via WhatsApp or email-in), it can still be linked back for a complete audit trail.

Bank rules: Create rules for recurring transactions (e.g. subscriptions), so categorisation happens automatically. Use these alongside supplier rules for consistent treatment, even when documentation arrives at different times.

In-app requests: Need paperwork for a specific transaction? Send a contextual prompt that lands on the client’s phone; they can snap and upload immediately.

Prioritised categorisation: Where both bank rules and supplier rules exist, Solo prioritises the categorisation from the cost document (as it’s typically the most accurate), while still attaching the transaction cleanly.

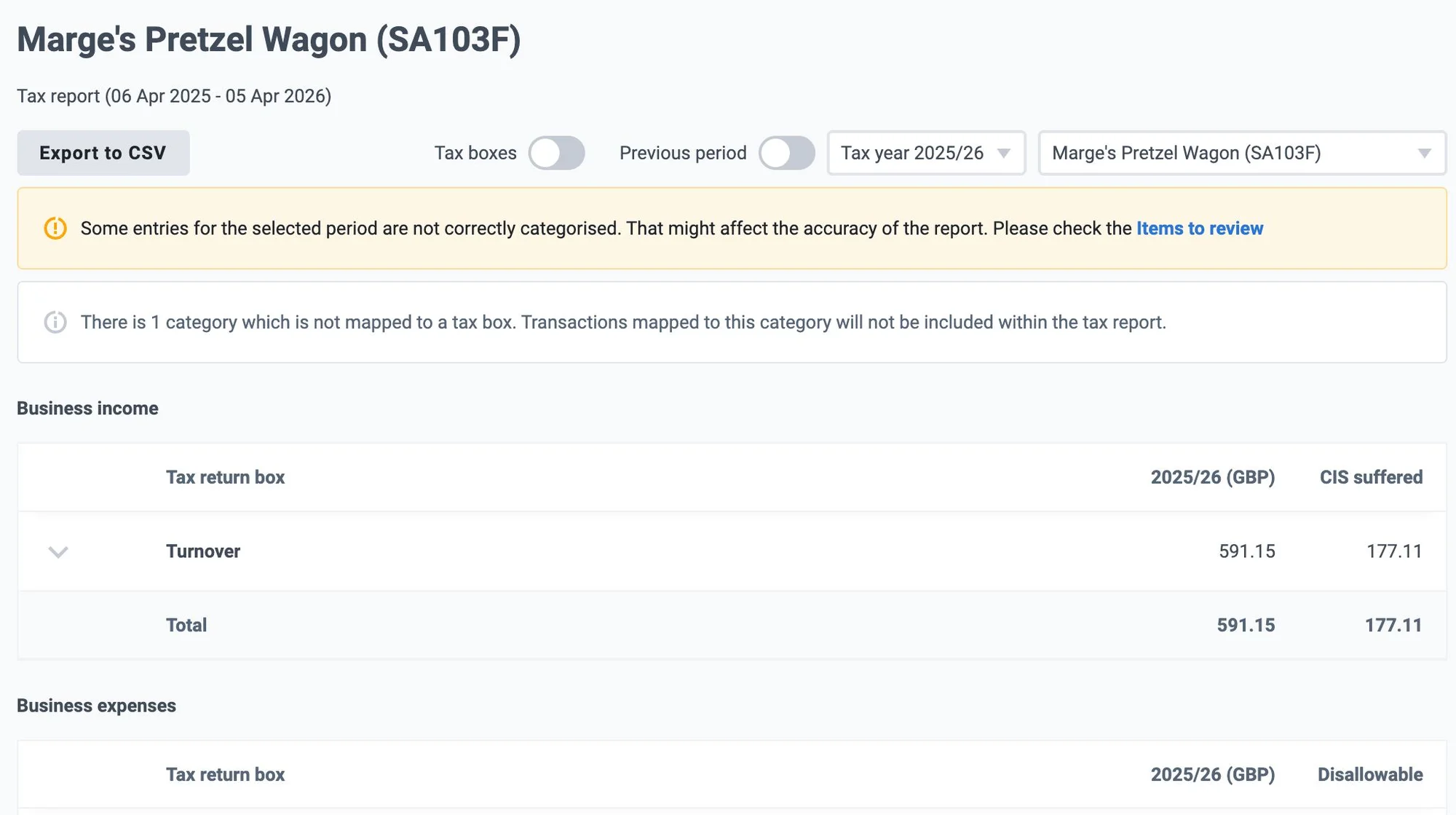

Reporting for readiness: see issues before the deadline

Solo gives you two core reports to validate data before each submission:

Transaction Summary: A comprehensive view of everything that has flowed into Solo—ideal for your first pass analytical review. Drill down by property or income stream, spot gaps and export a client-friendly summary if needed.

Tax Report: Rolls up items categorised to return boxes for a clean, review-ready picture. You can drill into each section to confirm details and make final tweaks before submission.

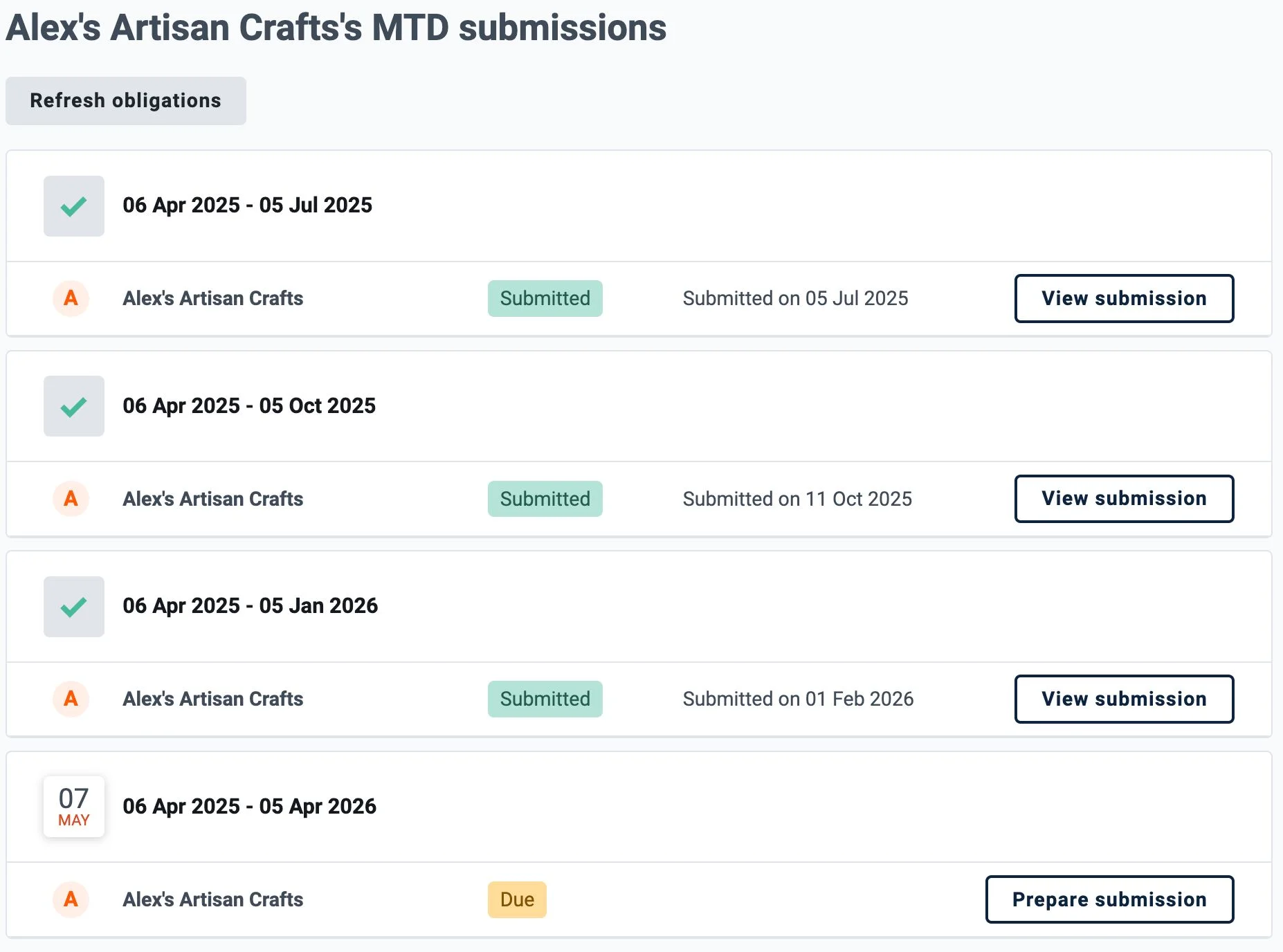

Submissions: clear, confident, and connected to HMRC

The submissions area shows what’s already been filed and what’s due next. Preparing a quarterly update is straightforward:

Open HMRC submissions to see obligations due and completed.

Select Prepare submission to review turnover, other business income, and expenditure.

Make any necessary adjustments, then confirm the figures are correct to the best of your knowledge.

Submit directly to HMRC from within Solo.

If clients have no additional complexities (e.g. dividends, capital gains, pensions), finalisation can be completed in Dext. If you prefer your existing finalisation suite (e.g. IRIS, Digita), continue with that; Solo’s quarterly updates feed HMRC directly, so your year-end routine remains intact.

Pricing with confidence: a framework that scales

As MTD for IT services evolve, transparent pricing matters—for both clients and firms. Our pricing proposal calculator (available now as a spreadsheet, with a live version to follow) helps you build tiers and incorporate key variables:

Tiered service: For example, Bronze (client-led with quarterly review and submission), Silver (shared effort), and Gold (firm-managed end-to-end).

Variables: Transactions per month and number of income streams—because time on a 10-transaction client differs from a 100-transaction client, even within the same tier.

Customisable inputs: Adjust base monthly charge and variable weightings to mirror your model. The calculator outputs a monthly and annual fee that reflects actual effort.

Focus on what’s changing: The framework prices the ongoing quarterly work. You can add your existing year-end return preparation fee on top for tax adjustments that sit outside Solo.

Licensing that fits MTD clients

Solo is designed to be accessible for firms scaling up across many self-employed and landlord clients. Bundled licence options keep costs predictable, and one Solo licence covers up to five income streams for a client—useful for those with both property and trading income.

Why firms choose Solo for MTD for IT

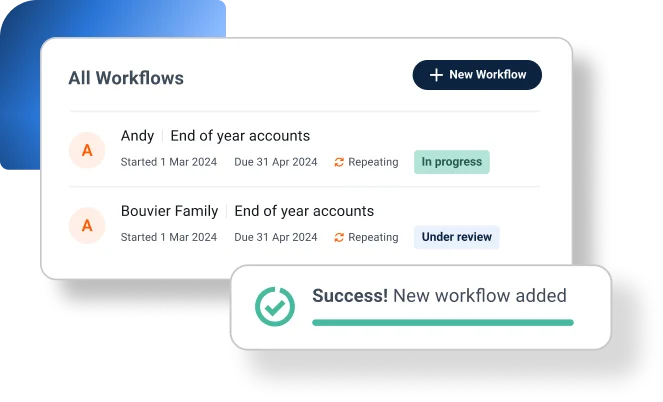

Repeatable workflows: Standardise capture, categorisation, and submissions across dozens or hundreds of clients.

Less chasing: Meet clients in the channels they already use (WhatsApp, email, mobile).

Higher confidence: Duplicate detection, disallowables automation, and full-text search reduce errors and speed up reviews.

Keep your year-end: Submit quarterly updates in Solo; continue using the finalisation suite you already trust if you prefer.

Try Dext yourself with our 14-day free trial

Dext Solo helps firms make MTD for IT routine: accurate records, fewer manual adjustments, and smooth quarterly updates—without reinventing your year-end. Onboard clients quickly, guide them to simple capture habits, and automate the repetitive bits so your team can focus on advisory work.